Should You Buy Or Sell QUBT Stock Ahead Of Earnings?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy or Sell QUBT Stock Ahead of Earnings? A Deep Dive for Investors

The upcoming earnings announcement for Qubits Systems, Inc. (QUBT) has investors buzzing. Should you buy, sell, or hold this volatile stock? Navigating the pre-earnings period requires careful analysis, and this in-depth look will help you make an informed decision. We'll explore recent performance, analyst predictions, and potential risks to give you a comprehensive understanding of the QUBT stock landscape before the big reveal.

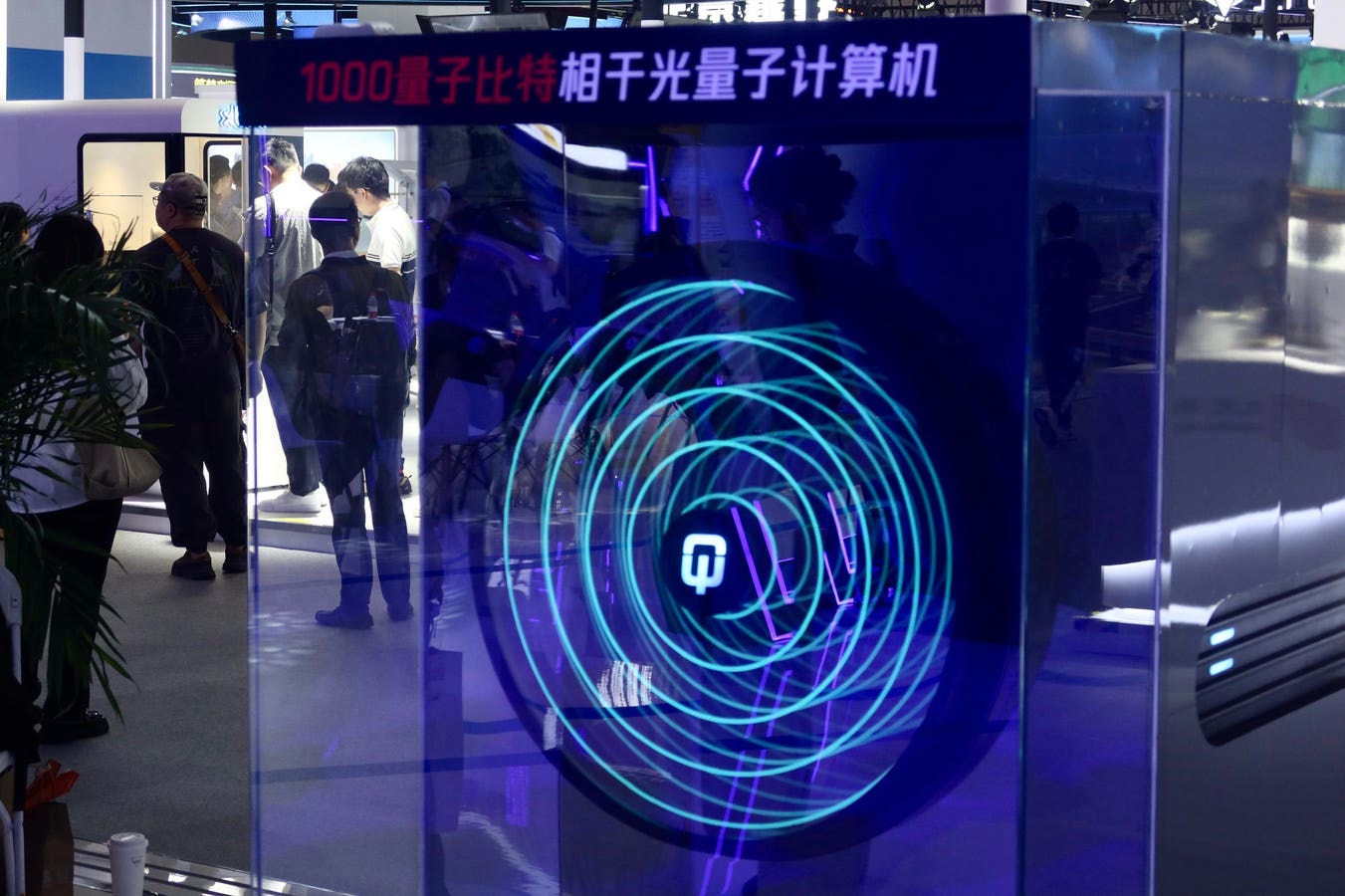

QUBT Stock: A Recent Performance Overview

QUBT, a company specializing in [insert QUBT's core business concisely, e.g., quantum computing solutions], has experienced a [describe recent performance – bullish, bearish, or sideways trend] trend in recent months. This volatility is partly due to [mention key factors influencing recent price movements, e.g., market sentiment towards the tech sector, recent partnerships, regulatory changes]. Understanding these underlying factors is crucial for predicting the stock's behavior following the earnings report. Key performance indicators (KPIs) like revenue growth, customer acquisition cost, and profit margins will be closely scrutinized by investors and analysts alike.

Analyst Predictions and Expectations

Analyst sentiment towards QUBT is [describe overall analyst sentiment – bullish, bearish, or mixed]. While some analysts predict [mention specific predictions, e.g., strong revenue growth, exceeding expectations], others remain cautious, citing [mention reasons for caution, e.g., increased competition, market saturation]. It's vital to consider a range of perspectives and not rely solely on a single prediction. Pay close attention to the consensus estimate for earnings per share (EPS) and revenue. A significant deviation from these expectations could trigger significant price fluctuations.

Potential Risks and Opportunities

Investing in QUBT, like any stock, involves inherent risks. These include:

- Market Volatility: The broader market's performance can significantly impact QUBT's stock price, regardless of its earnings.

- Competition: Increased competition within the [mention QUBT's industry] sector could put pressure on QUBT's market share and profitability.

- Technological Risks: The success of QUBT is heavily reliant on technological advancements. Failure to innovate could hinder future growth.

- Regulatory Uncertainty: Changes in regulations could impact QUBT's operations and profitability.

However, there are also significant opportunities:

- High Growth Potential: The [mention QUBT's industry] sector presents considerable growth potential, offering QUBT significant opportunities for expansion.

- First-Mover Advantage: QUBT's position as a [mention QUBT's market position] could give it a significant competitive edge.

- Strong Intellectual Property: A robust intellectual property portfolio could protect QUBT from competition and ensure long-term success.

Should You Buy, Sell, or Hold?

The decision to buy, sell, or hold QUBT stock before earnings hinges on your individual risk tolerance and investment strategy. If you have a high-risk tolerance and believe in QUBT's long-term potential, buying before earnings could be a viable strategy. However, if you're risk-averse, waiting for the earnings report to gauge the market's reaction might be a more prudent approach. Selling might be considered if you believe the stock is overvalued or if you're concerned about the potential downside risk.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Keywords: QUBT Stock, Qubits Systems, Stock Market, Earnings Report, Investment Strategy, Buy or Sell, Stock Prediction, [insert other relevant keywords related to QUBT's industry and business]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy Or Sell QUBT Stock Ahead Of Earnings?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

M6 Motorway Blocked Severe Delays And Live Traffic Updates

May 17, 2025

M6 Motorway Blocked Severe Delays And Live Traffic Updates

May 17, 2025 -

Five Ways Hbos Bessie Redefines Queer Cinema

May 17, 2025

Five Ways Hbos Bessie Redefines Queer Cinema

May 17, 2025 -

Tesco Website And App Down Thousands Of Customers Locked Out Of Accounts

May 17, 2025

Tesco Website And App Down Thousands Of Customers Locked Out Of Accounts

May 17, 2025 -

Chinese Satellite Laser Ranging A New Era Of Lunar Distance Measurement

May 17, 2025

Chinese Satellite Laser Ranging A New Era Of Lunar Distance Measurement

May 17, 2025 -

Hmstr Stock Alert Oversold Conditions Raise Questions For Hamster Kombat Investors

May 17, 2025

Hmstr Stock Alert Oversold Conditions Raise Questions For Hamster Kombat Investors

May 17, 2025