Significant Changes To FHA Residency Requirements: A Complete Guide

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Significant Changes to FHA Residency Requirements: A Complete Guide

The Federal Housing Administration (FHA) recently announced significant changes to its residency requirements, impacting thousands of potential homebuyers. These adjustments clarify existing rules and address ambiguities, making the home-buying process clearer for both borrowers and lenders. This comprehensive guide breaks down the key changes and explains what they mean for you.

What are FHA Loans?

Before diving into the residency changes, let's briefly recap FHA loans. These government-backed mortgages are designed to help first-time homebuyers and those with lower credit scores access homeownership. They typically require lower down payments than conventional loans, making them a popular choice. However, eligibility hinges on meeting specific requirements, including residency.

Key Changes to FHA Residency Requirements:

The most significant changes revolve around clarifying the definition of "principal residence" and strengthening verification processes. Previously, some ambiguity existed regarding temporary absences and the interpretation of "principal residence." The new guidelines aim to address this:

-

Stricter Definition of Principal Residence: The FHA now emphasizes a more stringent definition. While temporary absences are permissible (e.g., vacation, short-term work assignment), extended absences or maintaining a primary residence elsewhere will likely disqualify a borrower. The intention is to ensure the property is genuinely the borrower's primary dwelling.

-

Enhanced Verification Procedures: Lenders are now required to implement more robust verification processes to confirm the borrower's principal residence. This may include scrutinizing utility bills, tax returns, driver's licenses, and other supporting documentation. Expect a more thorough review of your residency status during the loan application process.

-

Focus on Intent: The FHA is placing greater emphasis on the borrower's intent to occupy the property as their primary residence. Simply owning a property and claiming it as a principal residence won't suffice. Evidence demonstrating the intent to live there permanently or long-term is crucial.

What Does This Mean for Homebuyers?

These changes primarily impact those who:

-

Frequently travel or have multiple residences: If you spend significant time outside the property you intend to finance, you'll need to demonstrate a clear intent to make it your primary home.

-

Are relocating for work: While short-term relocations are acceptable, long-term assignments in a different location may jeopardize your FHA loan application.

-

Own rental properties: Owning a rental property does not automatically disqualify you, but lenders will carefully assess your primary residence to ensure compliance.

How to Ensure Compliance:

To successfully navigate these updated residency requirements, consider these steps:

-

Gather comprehensive documentation: Prepare ample proof of residency, including utility bills, driver's license, tax returns, and any other relevant documents.

-

Be transparent with your lender: Openly discuss your living arrangements and any potential concerns with your lender upfront.

-

Consult with a mortgage professional: An experienced mortgage broker can guide you through the process and help you understand the implications of the new regulations.

Conclusion:

The recent changes to FHA residency requirements aim to ensure the integrity of the program and prevent fraudulent activities. While they add a layer of complexity, understanding these changes and preparing adequately can significantly increase your chances of securing an FHA loan. Proactive planning and transparent communication with your lender are key to a successful application. Remember, consulting with a qualified mortgage professional is strongly recommended to navigate these updated guidelines effectively.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Significant Changes To FHA Residency Requirements: A Complete Guide. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

When Does The Itzulia Basque Country Stage 1 Time Trial Begin

Apr 07, 2025

When Does The Itzulia Basque Country Stage 1 Time Trial Begin

Apr 07, 2025 -

Minecraft Moviegoers Report Increased Disruptive Behavior In Theaters

Apr 07, 2025

Minecraft Moviegoers Report Increased Disruptive Behavior In Theaters

Apr 07, 2025 -

2025 Japanese Gp Live Piastris Birthday Battle Against Dominant Verstappen

Apr 07, 2025

2025 Japanese Gp Live Piastris Birthday Battle Against Dominant Verstappen

Apr 07, 2025 -

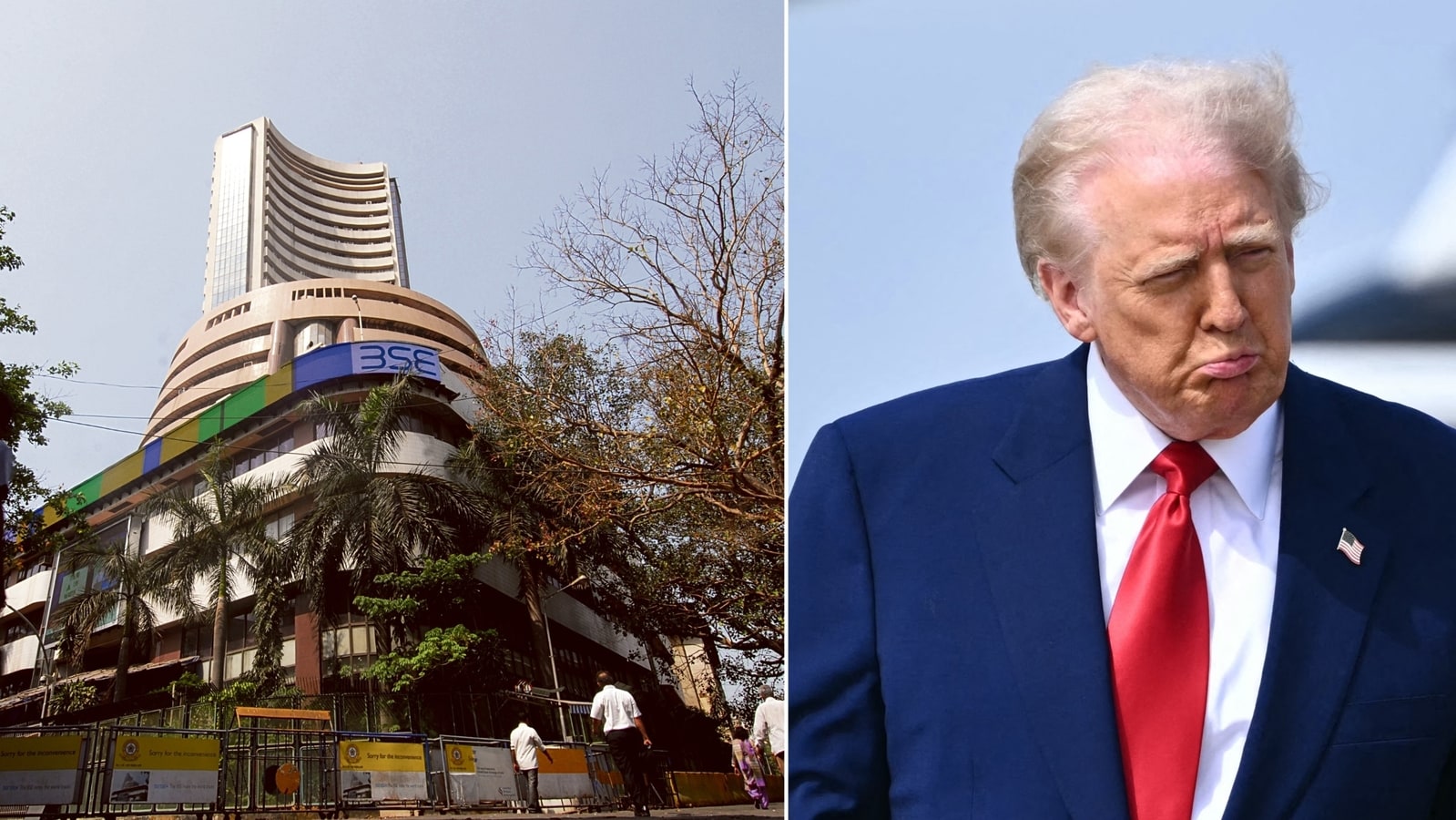

Indian Stock Market Downturn Causes Of The Sensex And Nifty Fall

Apr 07, 2025

Indian Stock Market Downturn Causes Of The Sensex And Nifty Fall

Apr 07, 2025 -

Predicting The Weather At The 2025 Masters Tournament Practice And Par 3 Forecasts

Apr 07, 2025

Predicting The Weather At The 2025 Masters Tournament Practice And Par 3 Forecasts

Apr 07, 2025