SSE Composite Index Plunges 6.06%: Market Analysis And Investor Concerns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SSE Composite Index Plunges 6.06%: Market Analysis and Investor Concerns

The Shanghai Stock Exchange Composite Index (SSE Composite) suffered a dramatic plunge of 6.06% today, sending shockwaves through global markets and raising serious concerns among investors. This significant drop marks the index's worst single-day performance in [insert timeframe, e.g., several months/years], highlighting growing anxieties surrounding the Chinese economy. Experts are scrambling to analyze the contributing factors behind this steep decline, and the implications for both domestic and international investors are substantial.

Understanding the Magnitude of the Fall

A 6.06% drop in a major index like the SSE Composite is not to be taken lightly. It signifies a significant loss of investor confidence and points towards potential underlying economic vulnerabilities. This sharp decline wiped billions of dollars off the market capitalization of listed companies, impacting countless investors and potentially triggering wider market instability. The speed and scale of the fall have left many questioning the stability of the Chinese stock market and its future trajectory.

Key Factors Contributing to the Plunge:

Several factors are believed to be contributing to the SSE Composite's dramatic fall. These include:

-

Concerns about China's Real Estate Sector: The ongoing crisis in China's real estate market, with prominent developers facing financial distress, continues to cast a long shadow over investor sentiment. Defaults and potential contagion effects are major concerns. Evergrande's struggles serve as a stark reminder of the systemic risks within this crucial sector.

-

Weakening Economic Data: Recent economic data released from China has painted a less-than-rosy picture. Slower-than-expected growth in key sectors, coupled with persistent inflationary pressures, has fueled anxieties about the country's economic outlook. This uncertainty is a significant driver of the market downturn.

-

Geopolitical Tensions: Increasing geopolitical tensions, particularly concerning [mention specific relevant geopolitical events, e.g., US-China relations or Taiwan], add to the overall instability and contribute to risk aversion among investors. This uncertainty discourages investment and fuels capital flight.

-

Regulatory Uncertainty: The Chinese government's regulatory actions, particularly in the technology sector, have created uncertainty and impacted investor confidence. Concerns about further regulatory crackdowns continue to weigh heavily on market sentiment.

Investor Reactions and Future Outlook:

The market's reaction has been swift and dramatic. Many investors are adopting a wait-and-see approach, while others are actively divesting from Chinese assets. The volatility is expected to continue in the short term, as investors grapple with the implications of the recent downturn.

What to Watch:

-

Government Intervention: The Chinese government's response will be crucial in determining the market's future trajectory. Any significant policy announcements or interventions could significantly influence investor sentiment.

-

Economic Data Releases: Upcoming economic data releases will be closely scrutinized for signs of improvement or further deterioration. These figures will play a key role in shaping investor expectations.

-

Real Estate Market Developments: Further developments in the real estate sector, including potential defaults or government bailouts, will continue to be a major driver of market volatility.

Conclusion:

The 6.06% plunge in the SSE Composite Index represents a significant event with far-reaching consequences. While the full impact remains to be seen, the current situation highlights the inherent risks associated with investing in emerging markets. Investors are urged to carefully assess their risk tolerance and diversify their portfolios to mitigate potential losses in the face of ongoing market uncertainty. The situation warrants close monitoring, and further updates will be provided as they become available.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SSE Composite Index Plunges 6.06%: Market Analysis And Investor Concerns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Home Run Streak Mike Trouts Recent Performance For The Los Angeles Angels

Apr 07, 2025

Home Run Streak Mike Trouts Recent Performance For The Los Angeles Angels

Apr 07, 2025 -

Collectible Alert Metal Mario Hot Wheels Car Release Date

Apr 07, 2025

Collectible Alert Metal Mario Hot Wheels Car Release Date

Apr 07, 2025 -

Japanese Firm Expands Msg Related Semiconductor Production

Apr 07, 2025

Japanese Firm Expands Msg Related Semiconductor Production

Apr 07, 2025 -

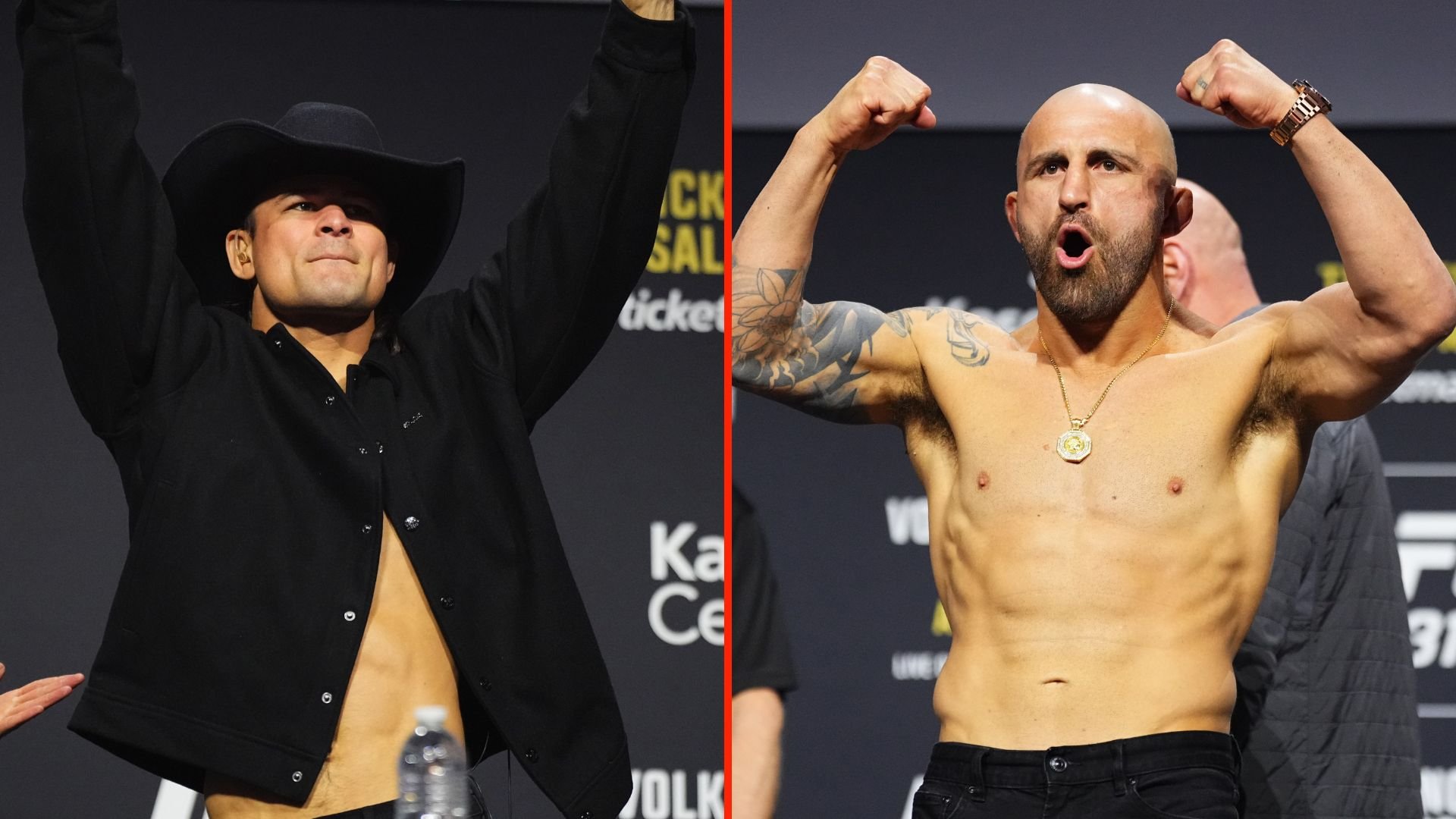

Volkanovski And Lopes Identical Plans For First Featherweight Defense Post Ufc 314

Apr 07, 2025

Volkanovski And Lopes Identical Plans For First Featherweight Defense Post Ufc 314

Apr 07, 2025 -

Amazon Stock And Tariffs A Guide For Investors Considering The Dip

Apr 07, 2025

Amazon Stock And Tariffs A Guide For Investors Considering The Dip

Apr 07, 2025