Standard Chartered Announces Share Repurchase: 891,878 Shares On April 3rd

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Standard Chartered Announces Significant Share Repurchase: Confidence in Future Growth?

Standard Chartered PLC, the London-based multinational banking and financial services corporation, announced a substantial share repurchase program on April 3rd, acquiring a total of 891,878 of its own shares. This move has sparked considerable interest amongst investors and analysts, prompting questions about the bank's confidence in its future performance and overall financial health. The repurchase signifies a strategic decision by Standard Chartered, and understanding its implications is crucial for anyone invested in or following the financial markets.

Details of the Share Repurchase

The share buyback, executed on April 3rd, saw Standard Chartered repurchase 891,878 of its ordinary shares. While the exact price per share wasn't publicly disclosed in immediate press releases, the transaction represents a significant investment in the company by the bank itself. Such actions are often seen as a positive sign, indicating that the company's leadership believes its shares are undervalued in the current market.

This buyback follows a period of relatively strong financial performance for Standard Chartered, albeit within a challenging global economic environment. The bank has been actively focusing on key strategic initiatives, including streamlining operations and expanding its presence in high-growth markets.

Why is this significant for investors?

Share buyback programs often signal several things to investors:

- Strong financial position: Companies typically undertake buybacks when they have substantial cash reserves and believe they can better utilize those funds by investing in themselves rather than external ventures. This suggests financial stability and confidence in future earnings.

- Undervalued shares: A buyback implies that the company's management believes its shares are trading below their intrinsic value. This can be a positive signal to investors, potentially leading to increased demand and a rise in share price.

- Return of capital to shareholders: Share buybacks can be viewed as a form of returning capital to shareholders, similar to dividend payouts. However, buybacks reduce the number of outstanding shares, potentially increasing earnings per share (EPS) and boosting share price.

Analyzing Standard Chartered's Strategic Move

This share repurchase needs to be viewed within the context of Standard Chartered's broader business strategy and the current macroeconomic landscape. The global banking sector faces numerous challenges, including rising interest rates and geopolitical uncertainty. Therefore, Standard Chartered’s move demonstrates a level of confidence in navigating these headwinds and achieving sustainable growth. Further analysis will be needed to fully understand the long-term implications of this action.

What's next for Standard Chartered?

Investors and analysts will be closely monitoring Standard Chartered's performance in the coming quarters. The success of the share repurchase strategy will depend on several factors, including the bank's ability to deliver on its financial targets and maintain its competitive advantage in a dynamic market. Further announcements regarding future buyback programs or dividend payouts could provide additional insight into Standard Chartered's long-term financial planning. Keep an eye on official company announcements and financial news outlets for updates.

Keywords: Standard Chartered, share repurchase, buyback, stock, shares, banking, finance, financial news, investment, investor, market, economy, global economy, April 3rd, 891,878 shares, stock market, financial markets, corporate finance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Standard Chartered Announces Share Repurchase: 891,878 Shares On April 3rd. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

After The Quake Myanmars Road To Recovery Amidst Civil War

Apr 07, 2025

After The Quake Myanmars Road To Recovery Amidst Civil War

Apr 07, 2025 -

Can Anyone Stop Real Madrid A Champions League Challenge

Apr 07, 2025

Can Anyone Stop Real Madrid A Champions League Challenge

Apr 07, 2025 -

Deploying Metas Llama 2 With Workers Ai A Step By Step Tutorial

Apr 07, 2025

Deploying Metas Llama 2 With Workers Ai A Step By Step Tutorial

Apr 07, 2025 -

Reliving The Past Shaping The Future Microsofts 50th Anniversary And Copilot

Apr 07, 2025

Reliving The Past Shaping The Future Microsofts 50th Anniversary And Copilot

Apr 07, 2025 -

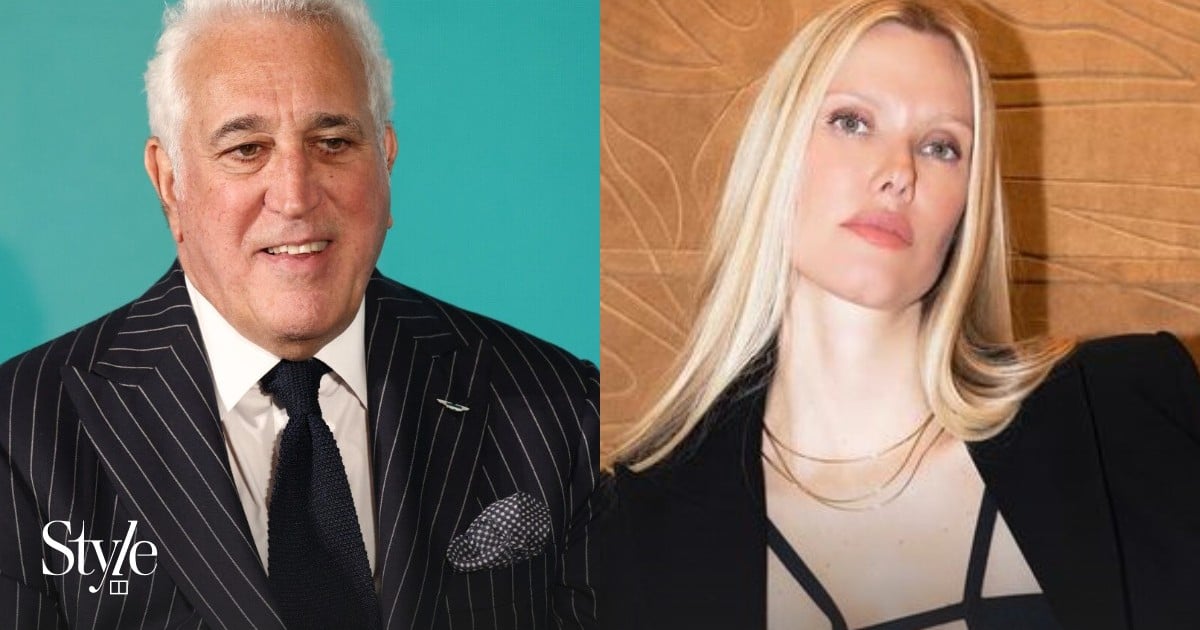

Get To Know Raquel Stroll Beyond The Aston Martin Connection

Apr 07, 2025

Get To Know Raquel Stroll Beyond The Aston Martin Connection

Apr 07, 2025