Standard Chartered's Capital Optimization Strategy: Share Buyback Details

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Standard Chartered Unveils Capital Optimization Strategy: Details on the Share Buyback

Standard Chartered PLC, a leading international banking group, recently announced a significant capital optimization strategy, a key component of which is a substantial share buyback program. This move signals the bank's confidence in its future prospects and its commitment to returning value to shareholders. The announcement has sent ripples through the financial markets, prompting keen interest in the specifics of the buyback. This article delves into the details of Standard Chartered's share buyback and its broader implications.

A Strategic Shift: More Than Just a Buyback

The share buyback isn't an isolated event; it's a core element of Standard Chartered's broader capital optimization strategy. This strategy aims to enhance shareholder returns while maintaining a robust capital position to support future growth and withstand potential economic headwinds. The bank's robust financial performance in recent quarters has provided the foundation for this initiative.

Key Details of the Share Buyback Program:

-

Size of the Buyback: Standard Chartered has authorized a share buyback program of up to [Insert Amount - replace with actual amount from the official announcement]. This represents a significant commitment to returning capital to investors.

-

Timeline: The buyback is expected to commence on [Insert Start Date - replace with actual start date from official announcement] and conclude by [Insert End Date - replace with actual end date from official announcement] or earlier, depending on market conditions.

-

Funding: The buyback will be funded from existing capital reserves, ensuring the bank maintains a healthy capital ratio.

-

Market Impact: The announcement has been generally well-received by the market, with analysts citing the buyback as a positive sign of the bank's financial strength and confidence in its future earnings. Share prices have [Insert impact on share price – e.g., "seen a modest increase" or "remained relatively stable" ] following the announcement.

Why is Standard Chartered Implementing a Share Buyback?

Standard Chartered's decision to initiate a share buyback is driven by several factors:

-

Strong Financial Performance: The bank's improved financial performance in recent periods has generated excess capital, providing the opportunity for capital return.

-

Shareholder Value: The buyback directly increases shareholder value by reducing the number of outstanding shares, thereby increasing earnings per share (EPS).

-

Strategic Positioning: By optimizing its capital allocation, Standard Chartered aims to strengthen its competitive position and attract further investment.

-

Confidence in Future Growth: The buyback demonstrates the bank’s confidence in its long-term growth prospects and ability to generate strong future returns.

Implications for Investors:

The share buyback presents a positive development for existing shareholders. The reduction in the number of outstanding shares could lead to increased earnings per share, potentially boosting the share price. However, investors should always conduct their own thorough due diligence before making any investment decisions.

Looking Ahead:

Standard Chartered's capital optimization strategy, including the share buyback, represents a significant step in enhancing shareholder value and strengthening the bank's position in the global financial market. The success of this strategy will depend on several factors, including continued strong performance, favorable market conditions, and effective execution of the buyback program. Further updates and details regarding the buyback's progress are expected in the coming months. Investors should monitor official announcements from Standard Chartered for the latest information.

Keywords: Standard Chartered, share buyback, capital optimization, shareholder return, financial performance, earnings per share (EPS), investment, banking, international banking, stock market, financial news.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Standard Chartered's Capital Optimization Strategy: Share Buyback Details. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Sigma Developing A 200mm F1 8 Mirrorless Lens Speculation And Potential Impact

Apr 07, 2025

Is Sigma Developing A 200mm F1 8 Mirrorless Lens Speculation And Potential Impact

Apr 07, 2025 -

Where To Invest 1 000 In Tech Top Stock Recommendations

Apr 07, 2025

Where To Invest 1 000 In Tech Top Stock Recommendations

Apr 07, 2025 -

2025 Formula 1 Japanese Grand Prix Live Timing News And Analysis

Apr 07, 2025

2025 Formula 1 Japanese Grand Prix Live Timing News And Analysis

Apr 07, 2025 -

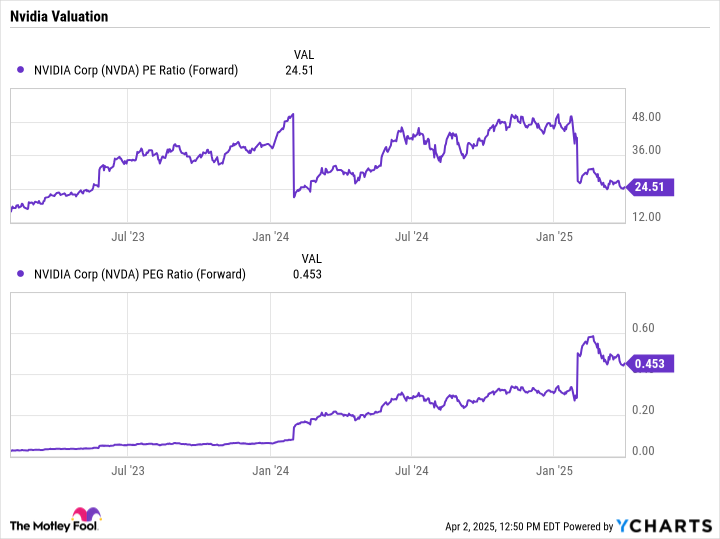

Nvidias Growth Potential 3 Reasons To Invest In Nvda Stock

Apr 07, 2025

Nvidias Growth Potential 3 Reasons To Invest In Nvda Stock

Apr 07, 2025 -

Space X Starship A New Era For Global Cargo Logistics And Fuel Infrastructure

Apr 07, 2025

Space X Starship A New Era For Global Cargo Logistics And Fuel Infrastructure

Apr 07, 2025