Where To Invest $1,000 In Tech: Top Stock Recommendations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Where to Invest $1,000 in Tech: Top Stock Recommendations for 2024

The tech sector, a volatile yet potentially lucrative landscape, presents exciting investment opportunities for even small sums. With just $1,000, you can gain exposure to groundbreaking technologies and potentially significant returns. But where should you put your money? This article provides expert insights and top stock recommendations for tech investments in 2024, carefully considering risk and potential reward.

Navigating the Tech Investment Landscape:

Investing in tech can be daunting. The industry is characterized by rapid innovation and fierce competition, making it crucial to conduct thorough research before committing your capital. Consider your risk tolerance: are you comfortable with potentially higher returns alongside higher risk, or do you prefer a more conservative approach? Diversification is key—spreading your investment across multiple companies mitigates risk.

Top Stock Recommendations for Your $1,000:

While past performance doesn't guarantee future results, analyzing current market trends and company performance can inform smart investment decisions. Here are some potential avenues for your $1,000 tech investment, categorized by risk level:

Lower Risk (Established Players):

- Microsoft (MSFT): A tech giant with a diversified portfolio including cloud computing (Azure), software (Office 365), and gaming (Xbox). MSFT offers relative stability compared to newer companies. Consider this a solid foundation for your portfolio.

- Google (GOOGL): Dominant in search, advertising, and cloud computing (Google Cloud Platform), Google boasts consistent revenue growth and a strong market position. This is another established player with lower inherent risk.

- Apple (AAPL): A global leader in consumer electronics and services, Apple enjoys strong brand loyalty and a vast ecosystem. While its stock price can fluctuate, its consistent performance makes it a reliable addition to a diversified portfolio.

Medium Risk (Growth Potential):

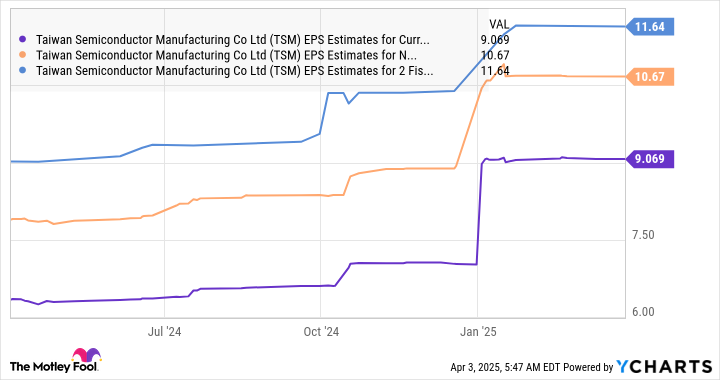

- Nvidia (NVDA): A leader in graphics processing units (GPUs), crucial for artificial intelligence (AI) and gaming. NVDA's future is heavily tied to the growth of AI, presenting both significant potential and higher volatility.

- Advanced Micro Devices (AMD): A competitor to Intel and Nvidia, AMD is making strides in the CPU and GPU markets, making it a compelling option for investors seeking growth in the semiconductor industry.

Higher Risk (High Growth, High Volatility):

- Cybersecurity Companies: The increasing reliance on technology has led to a surge in cybersecurity threats. Investing in established cybersecurity companies can be profitable, but the sector is competitive and subject to market fluctuations. Thorough research is crucial before investing in this sector.

- Specific AI Companies: While many tech giants are investing heavily in AI, smaller, more specialized AI companies could offer significant returns but carry a correspondingly higher level of risk. Due diligence is paramount.

Important Considerations:

- Fractional Shares: Many brokerage platforms allow you to purchase fractional shares, allowing you to invest in expensive stocks even with a small amount of capital.

- Diversification: Don't put all your eggs in one basket. Spread your $1,000 across several companies to mitigate risk.

- Dollar-Cost Averaging (DCA): Instead of investing your entire $1,000 at once, consider DCA. This strategy involves investing smaller amounts regularly over time, reducing the impact of market volatility.

- Long-Term Perspective: Investing in the stock market is a long-term game. Avoid impulsive decisions based on short-term market fluctuations. Patience and a long-term strategy are key.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions. Investing in the stock market carries inherent risks, and you could lose money.

This information is for educational purposes only and does not constitute investment advice. Always conduct your own thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Where To Invest $1,000 In Tech: Top Stock Recommendations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

When You Cant Win Take A Point Diabys Tactical Analysis Of The Al Ittihad Al Ahli Clash

Apr 07, 2025

When You Cant Win Take A Point Diabys Tactical Analysis Of The Al Ittihad Al Ahli Clash

Apr 07, 2025 -

Rockets Strong Performance Leads To 10 Point Win Over Warriors

Apr 07, 2025

Rockets Strong Performance Leads To 10 Point Win Over Warriors

Apr 07, 2025 -

Nyt Connections Answers For Monday April 7th

Apr 07, 2025

Nyt Connections Answers For Monday April 7th

Apr 07, 2025 -

25 Drop In Ai Stock Should You Invest Before April 17

Apr 07, 2025

25 Drop In Ai Stock Should You Invest Before April 17

Apr 07, 2025 -

Chappell Roan Speaks Truth The Challenges And Realities Of American Parenthood

Apr 07, 2025

Chappell Roan Speaks Truth The Challenges And Realities Of American Parenthood

Apr 07, 2025