Standard Chartered's Share Buyback: A Strategic Capital Optimization Move

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Standard Chartered's Share Buyback: A Strategic Capital Optimization Move

Standard Chartered PLC, a leading international banking group, recently announced a significant share buyback program, marking a strategic shift in its capital management approach. This move, designed to optimize capital allocation and boost shareholder returns, has sent ripples through the financial markets and sparked considerable discussion among analysts and investors. This article delves into the details of the buyback, its implications for Standard Chartered, and its broader significance within the context of the current global economic landscape.

Why the Share Buyback? A Strategic Capital Allocation Decision

Standard Chartered's decision to initiate a share buyback isn't impulsive; it's a carefully considered strategic move reflecting the bank's strong financial position and confidence in its future prospects. The bank cited a robust capital base and improved profitability as key drivers behind this initiative. By repurchasing its own shares, Standard Chartered aims to:

- Enhance Return on Equity (ROE): Reducing the number of outstanding shares directly increases earnings per share (EPS), thereby boosting ROE – a crucial metric for evaluating a bank's profitability and efficiency.

- Signal Confidence: The buyback serves as a strong signal to investors, demonstrating the board's confidence in the bank's long-term growth potential and financial strength. This can positively impact the share price.

- Optimize Capital Structure: By repurchasing shares, Standard Chartered can optimize its capital structure, potentially leading to improved efficiency and reduced cost of capital.

- Return Value to Shareholders: A share buyback is a direct way to return value to shareholders, providing an alternative to dividend payouts. This can be particularly attractive to investors seeking capital appreciation.

Details of the Buyback Program

The specifics of Standard Chartered's share buyback program, including the total amount allocated and the timeframe for the repurchases, will be crucial in assessing its overall impact. Investors should carefully review the official announcements from the bank for precise details on the buyback's execution. Close monitoring of the share price and trading volume during the buyback period will provide valuable insights into market reaction.

Implications for Investors and the Broader Market

Standard Chartered's share buyback represents a significant development, not just for the bank itself, but also for the broader banking sector and the investment community. It could potentially:

- Influence Sector Sentiment: The move might influence investor sentiment towards other banks, encouraging similar capital optimization strategies.

- Impact Share Price Volatility: The buyback program is likely to introduce some volatility into Standard Chartered's share price, influenced by market forces and investor response.

- Attract Increased Investor Interest: The buyback could attract new investors seeking strong capital returns and a positive outlook on the bank's future.

Analyzing the Long-Term Effects

While the immediate impact of a share buyback is often visible in the form of increased share price and EPS, assessing the long-term implications requires a more comprehensive analysis. Factors such as the overall economic climate, the bank's future performance, and competitive dynamics will all play significant roles in shaping the ultimate success of this strategic decision. Continuous monitoring of Standard Chartered's financial reports and announcements will be crucial for investors seeking to understand the long-term ramifications of this buyback.

Conclusion: A Calculated Strategy

Standard Chartered's share buyback program represents a strategic capital optimization move reflecting the bank's strong financial position and positive outlook. While the short-term effects might be evident in share price fluctuations, the long-term success will hinge on the bank’s continued performance and adaptation to the evolving global financial landscape. This calculated move positions Standard Chartered for future growth and underscores its commitment to maximizing shareholder value. The ongoing impact of this decision will undoubtedly remain a key area of focus for analysts and investors alike.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Standard Chartered's Share Buyback: A Strategic Capital Optimization Move. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Five Trades Electrify Round 1 A Bold 2025 Nfl Mock Draft Prediction

Apr 08, 2025

Five Trades Electrify Round 1 A Bold 2025 Nfl Mock Draft Prediction

Apr 08, 2025 -

Us Stock Market Freefall Dow Futures Drop 1300 Points Amid Tariff Crisis

Apr 08, 2025

Us Stock Market Freefall Dow Futures Drop 1300 Points Amid Tariff Crisis

Apr 08, 2025 -

Rio Grande Do Sul Balanco De Destruicao Apos Chuvas Intensas 75 Vitimas E Crise Generalizada

Apr 08, 2025

Rio Grande Do Sul Balanco De Destruicao Apos Chuvas Intensas 75 Vitimas E Crise Generalizada

Apr 08, 2025 -

Il Peso Della Storia Come La Sampdoria Gestisce L Eredita Del Passato

Apr 08, 2025

Il Peso Della Storia Come La Sampdoria Gestisce L Eredita Del Passato

Apr 08, 2025 -

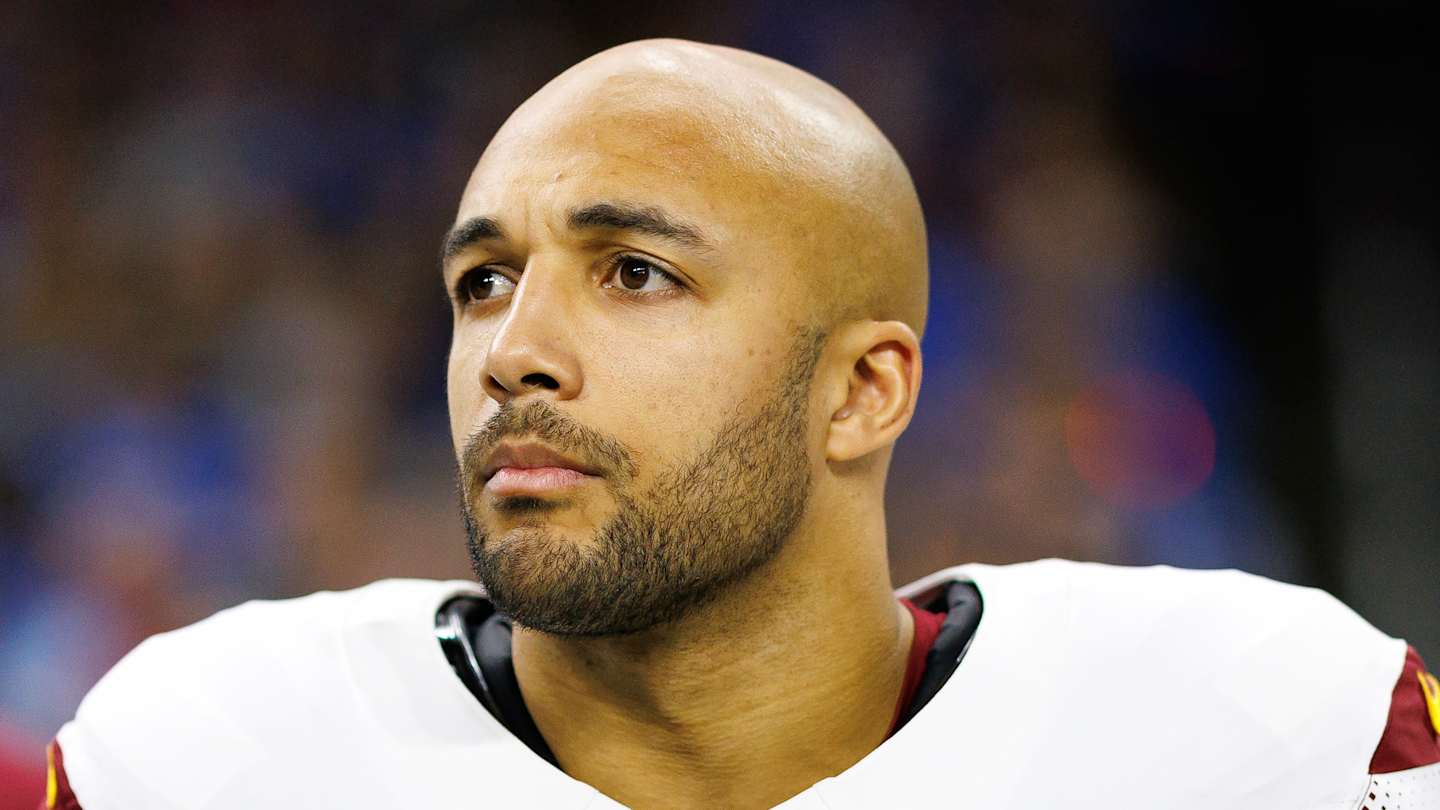

Seven Washington Commanders Likely To Retire After This Season

Apr 08, 2025

Seven Washington Commanders Likely To Retire After This Season

Apr 08, 2025