Tariff Relief And US Auto Industry: A Former Trump Official's Bold Prediction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tariff Relief and US Auto Industry: A Former Trump Official's Bold Prediction

The US auto industry, long a battleground in the trade wars of recent years, is bracing for potential shifts as a former Trump administration official makes a bold prediction about tariff relief. This could significantly impact automakers, consumers, and the broader US economy. The statement has sent ripples through the industry, prompting speculation about the future of automotive manufacturing and pricing in the United States.

A Shift in the Sands of Trade Policy?

The prediction, made by [Name of Former Official] during a recent interview with [Publication Name], suggests a potential easing of tariffs on imported auto parts and vehicles. This comes as a surprise to many, given the protectionist stance adopted during the previous administration. [He/She] argued that the current tariff structure, implemented under [Specific Tariff Policy/Act], has ultimately harmed the US auto industry more than it has helped. The claim centers on the argument that increased costs for imported parts have led to higher prices for consumers and reduced competitiveness for American automakers in the global market.

The Impact on American Automakers

The potential for tariff relief is a double-edged sword for US automakers. While it could lower production costs and allow for more competitive pricing, it also presents challenges. Increased competition from foreign manufacturers could squeeze profit margins and potentially lead to job losses in certain sectors. The success of American automakers in adapting to this potential shift will depend on their ability to innovate and offer products that meet evolving consumer demands.

- Reduced Production Costs: Lower tariffs would translate to cheaper imported parts, directly impacting the bottom line for auto manufacturers.

- Increased Competition: A flood of more affordable imported vehicles could intensify competition and pressure domestic manufacturers to improve efficiency and offer more competitive pricing.

- Potential Job Displacement: While some argue that tariff relief could create jobs in other sectors, there’s concern about potential job losses in areas heavily reliant on tariff-protected domestic production.

Consumer Implications: Lower Prices or Increased Choice?

For consumers, the potential outcome is a complex equation. While lower tariffs could translate to cheaper vehicles, the actual impact will depend on several factors, including the degree of tariff reduction and the responses of automakers.

- Lower Vehicle Prices: Reduced costs of production could translate to lower prices for consumers, making vehicles more accessible.

- Wider Vehicle Selection: Consumers might see a wider range of vehicles available in the market, as import restrictions ease.

- Potential Price Wars: Increased competition could lead to price wars, potentially benefiting consumers in the short term, but potentially harming the long-term viability of some automakers.

Looking Ahead: Uncertainty and Opportunity

The former official's prediction highlights the inherent uncertainty surrounding future trade policy. While the possibility of tariff relief offers exciting potential benefits, navigating the complexities of global trade remains a significant challenge. The US auto industry will need to adapt strategically, focusing on innovation, efficiency, and competitive pricing to thrive in this evolving landscape. The coming months will be crucial in determining the real impact of these potential policy shifts. This situation warrants close monitoring by industry stakeholders, economists, and policymakers alike. The future of the US auto industry, and its relationship with global trade, remains a story still unfolding.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tariff Relief And US Auto Industry: A Former Trump Official's Bold Prediction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Patient Privacy At Risk Thousands Of Health Records Potentially Compromised

Apr 30, 2025

Patient Privacy At Risk Thousands Of Health Records Potentially Compromised

Apr 30, 2025 -

Thunderbolts A Critique Of The Films Low Stakes Action

Apr 30, 2025

Thunderbolts A Critique Of The Films Low Stakes Action

Apr 30, 2025 -

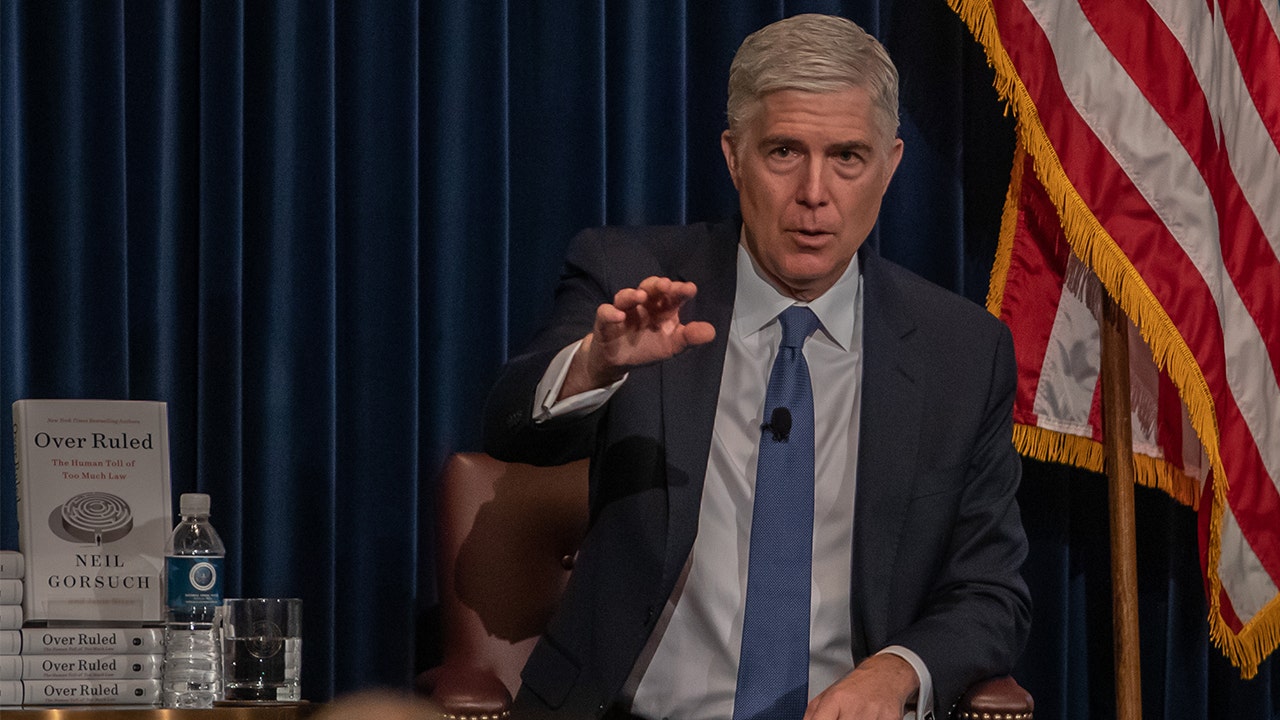

Supreme Court Tension Gorsuch And Litigator In Heated Verbal Sparring

Apr 30, 2025

Supreme Court Tension Gorsuch And Litigator In Heated Verbal Sparring

Apr 30, 2025 -

Analysis Of Dual Propulsion Experiments Conducted On Otp 2

Apr 30, 2025

Analysis Of Dual Propulsion Experiments Conducted On Otp 2

Apr 30, 2025 -

A24s The Smashing Machine Benny Safdie Directs Dwayne Johnson Biopic

Apr 30, 2025

A24s The Smashing Machine Benny Safdie Directs Dwayne Johnson Biopic

Apr 30, 2025

Latest Posts

-

Science In War Examining Its Impact Episode 3

Apr 30, 2025

Science In War Examining Its Impact Episode 3

Apr 30, 2025 -

Classroom Violence Singapore Student Arrested For Attacking Teacher With Penknife

Apr 30, 2025

Classroom Violence Singapore Student Arrested For Attacking Teacher With Penknife

Apr 30, 2025 -

Ripples Xrp Jumps To 2 35 On Positive Futures Etf News

Apr 30, 2025

Ripples Xrp Jumps To 2 35 On Positive Futures Etf News

Apr 30, 2025 -

Is The Madden Nfl 26 Release Date Officially Leaked

Apr 30, 2025

Is The Madden Nfl 26 Release Date Officially Leaked

Apr 30, 2025 -

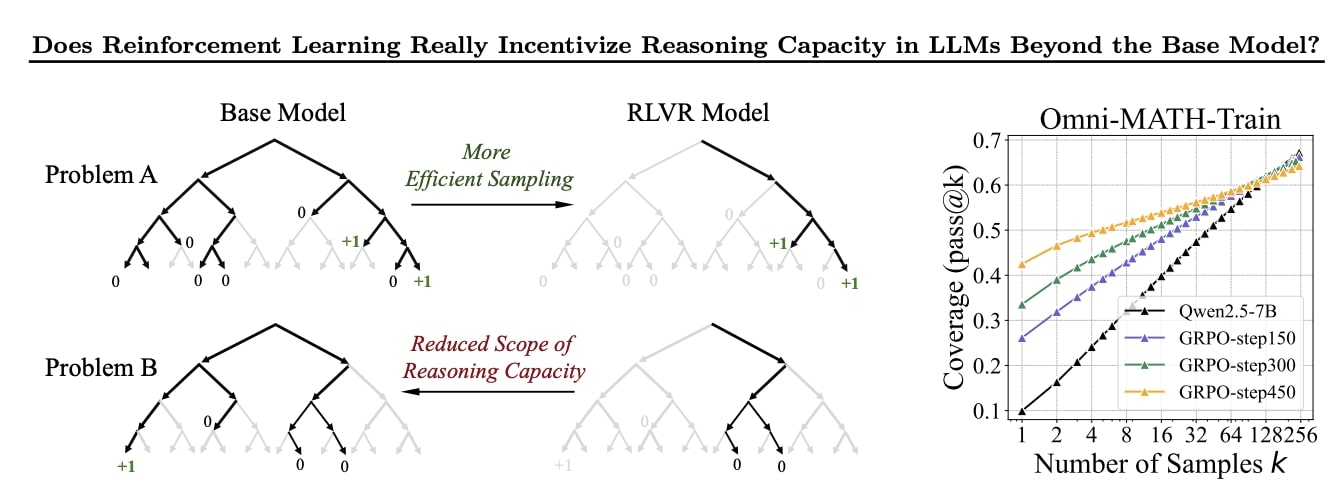

Evaluating The Actual Impact Of Reinforcement Learning On Ai

Apr 30, 2025

Evaluating The Actual Impact Of Reinforcement Learning On Ai

Apr 30, 2025