The Maturing Crypto Market Needs Modern Tax Regulations.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Maturing Crypto Market Needs Modern Tax Regulations

The cryptocurrency market, once a Wild West of decentralized finance, is rapidly evolving into a sophisticated global asset class. With institutional adoption surging and mainstream awareness growing, the urgent need for clear and modern tax regulations is undeniable. The current patchwork of laws leaves investors and businesses grappling with uncertainty, hindering growth and potentially stifling innovation.

The Current Regulatory Landscape: A Patchwork of Confusion

Currently, the tax treatment of cryptocurrencies varies wildly across jurisdictions. Many countries still lack specific legislation, leaving taxpayers to navigate ambiguous guidelines and potentially face hefty penalties for unintentional non-compliance. This ambiguity creates several significant problems:

- Uncertainty for Investors: Determining the capital gains tax implications of cryptocurrency transactions can be incredibly complex. Is it considered property, a currency, or something else entirely? The lack of clear definitions leads to confusion and potentially costly mistakes.

- Challenges for Businesses: Businesses accepting cryptocurrency payments or holding crypto assets on their balance sheets face similar hurdles. Accounting for crypto transactions and reporting them accurately is a significant challenge in the absence of standardized regulations.

- Inconsistent Enforcement: The inconsistent application of existing tax laws across different jurisdictions creates an uneven playing field and potentially attracts illicit activities.

Why Modern Tax Regulations Are Crucial for Growth

Modern and clear tax regulations are not just about compliance; they are fundamental to the healthy growth of the cryptocurrency market. Here's why:

- Increased Investor Confidence: Clear regulations would encourage institutional investment and boost mainstream adoption by reducing the risk associated with tax uncertainties.

- Stimulated Innovation: A predictable regulatory environment fosters innovation by allowing businesses to focus on developing new products and services without the constant fear of tax-related liabilities.

- Improved Market Transparency: Standardized reporting requirements would increase transparency and help prevent money laundering and other illicit activities.

- Fairer Tax System: Equitable tax laws ensure that all participants in the cryptocurrency market contribute fairly to the economy.

What Should Modern Crypto Tax Regulations Include?

Effective crypto tax regulations should address several key areas:

- Clear Definitions: The regulations should clearly define cryptocurrencies and their tax treatment, eliminating ambiguity and providing certainty for taxpayers.

- Simplified Reporting: Streamlined reporting mechanisms, potentially integrating with existing tax systems, are essential to reduce the burden on individuals and businesses.

- Consistent Global Standards: International cooperation is crucial to create consistent global standards, preventing tax arbitrage and fostering a level playing field for all market participants.

- Technological Adaptation: Regulations should be adaptable to the rapidly evolving nature of the cryptocurrency landscape, incorporating blockchain technology and other innovations.

The Path Forward: Collaboration and Innovation

The development of effective cryptocurrency tax regulations requires collaboration between governments, regulators, industry stakeholders, and tax professionals. Open dialogue and a willingness to adapt to the unique characteristics of the crypto market are essential for creating a framework that promotes innovation while ensuring fair and efficient tax collection. Ignoring this evolving landscape will only lead to further complications and missed opportunities. The future of finance is intertwined with the future of crypto, and responsible regulation is the key to unlocking its full potential.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Maturing Crypto Market Needs Modern Tax Regulations.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

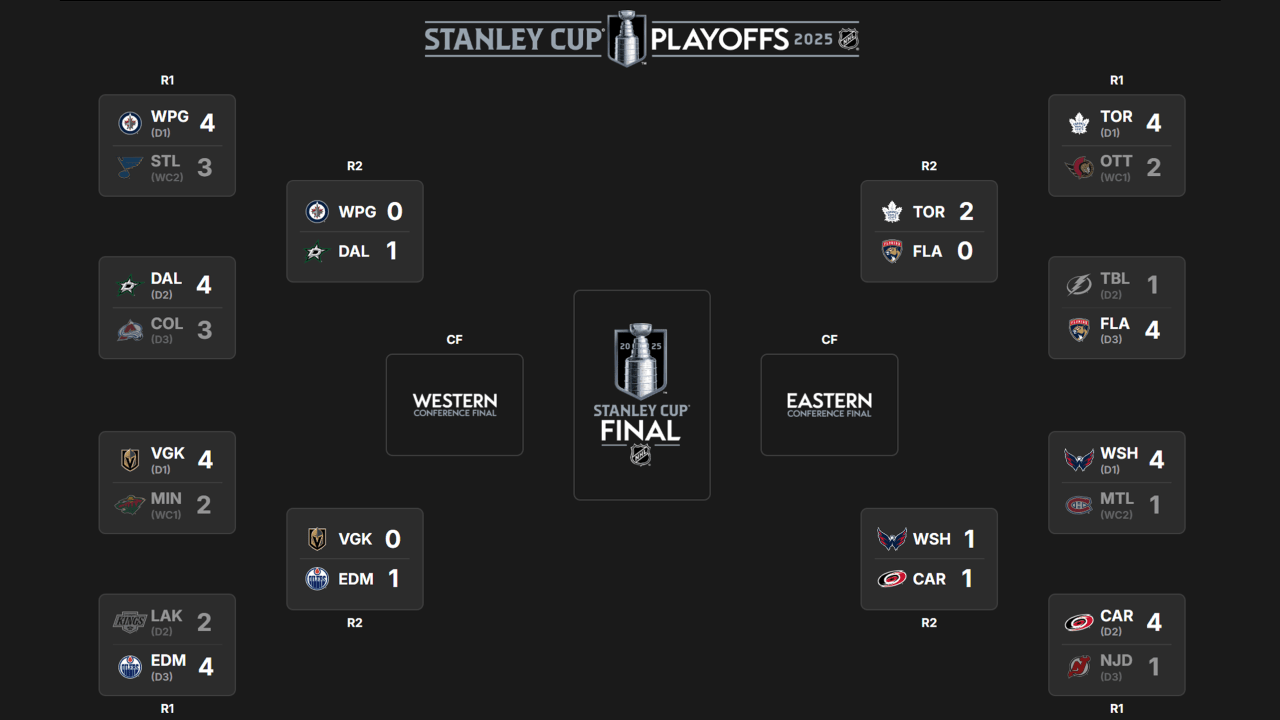

Complete Guide 2025 Stanley Cup Playoffs Second Round Schedule

May 09, 2025

Complete Guide 2025 Stanley Cup Playoffs Second Round Schedule

May 09, 2025 -

Golden State Vs Minnesota Key Moments And Final Score May 6 2025 Nba Playoffs

May 09, 2025

Golden State Vs Minnesota Key Moments And Final Score May 6 2025 Nba Playoffs

May 09, 2025 -

Decoding Zara Understanding Its Supply Chain And Design Process

May 09, 2025

Decoding Zara Understanding Its Supply Chain And Design Process

May 09, 2025 -

Top News Your Hindu Morning Digest For May 9 2025

May 09, 2025

Top News Your Hindu Morning Digest For May 9 2025

May 09, 2025 -

Cheap Beats Headphones Sales And Deals For May 2025

May 09, 2025

Cheap Beats Headphones Sales And Deals For May 2025

May 09, 2025