This Bitcoin Metric Might Give A False Buy Signal: Are You Prepared?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

This Bitcoin Metric Might Give a False Buy Signal: Are You Prepared?

Bitcoin's price volatility keeps investors on edge, constantly searching for reliable indicators to guide their investment decisions. One such indicator, the stock-to-flow (S2F) model, has gained significant popularity, promising to predict Bitcoin's future price. However, recent market behavior raises concerns: could the S2F model be sending a false buy signal, leaving investors vulnerable?

The S2F model, originally proposed by analyst PlanB, posits a correlation between Bitcoin's scarcity (stock) and its price (flow). By comparing the existing supply of Bitcoin to the newly mined coins, the model attempts to predict future price appreciation. It's gained a considerable following, partly due to its seemingly accurate predictions in the past. However, its reliability is now under scrutiny.

Why the S2F Model Might Be Failing

Several factors cast doubt on the S2F model's current predictive power:

-

Market Maturity: Bitcoin's market has matured significantly since the model's inception. Early adoption drove exponential growth, aligning with the S2F model's projections. However, a more established market is influenced by a wider range of factors beyond mere supply and demand, including regulatory changes, macroeconomic conditions, and investor sentiment.

-

Halving Events: The S2F model heavily relies on Bitcoin's halving events – periodic reductions in the rate of new Bitcoin creation. While past halvings have been followed by price increases, this correlation isn't guaranteed to continue indefinitely. Market dynamics evolve, and past performance isn't indicative of future results.

-

External Factors: The model fails to account for external factors significantly impacting Bitcoin's price. Geopolitical events, economic downturns, and regulatory crackdowns can override the influence of supply and demand dynamics predicted by the S2F model. The recent cryptocurrency market crash, for instance, demonstrated this vulnerability.

-

Adoption Rate: While the S2F model considers supply, it doesn't fully incorporate the crucial element of adoption rate. Widespread adoption would theoretically drive price up regardless of the S2F ratio, while slow adoption could negate the model's predictions.

What Should Investors Do?

The S2F model, while intriguing, shouldn't be the sole basis for Bitcoin investment decisions. Instead, investors should adopt a more holistic approach, considering a broader range of factors:

-

Diversification: Don't put all your eggs in one basket. Diversify your portfolio across various assets to mitigate risk.

-

Fundamental Analysis: Examine Bitcoin's underlying technology, adoption rate, and network effects.

-

Technical Analysis: Use technical indicators alongside fundamental analysis to identify potential entry and exit points.

-

Risk Management: Develop a robust risk management strategy, including stop-loss orders and position sizing.

-

Stay Informed: Keep abreast of market developments, regulatory changes, and macroeconomic trends influencing the cryptocurrency market.

Conclusion:

While the stock-to-flow model provides a fascinating perspective on Bitcoin's potential, it's crucial to recognize its limitations. Relying solely on this metric could lead to inaccurate investment decisions. A prudent investor will incorporate diverse analytical tools and risk management strategies to navigate the volatile world of Bitcoin and cryptocurrency investments. The S2F model might be giving a false buy signal; are you prepared for the consequences?

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on This Bitcoin Metric Might Give A False Buy Signal: Are You Prepared?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

When You Cant Win Take A Point Diabys Tactical Analysis Of The Al Ittihad Al Ahli Clash

Apr 07, 2025

When You Cant Win Take A Point Diabys Tactical Analysis Of The Al Ittihad Al Ahli Clash

Apr 07, 2025 -

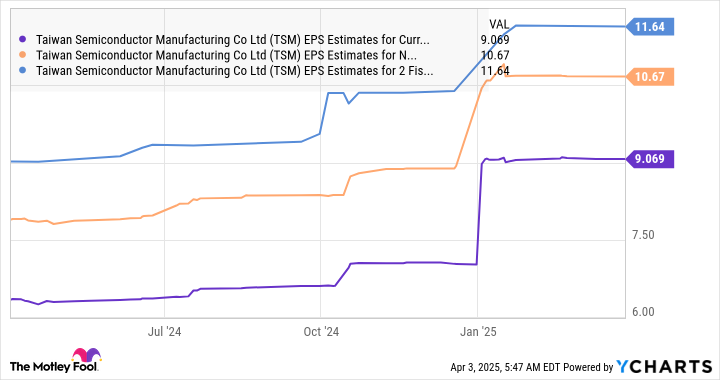

Top Ai Stock Down 25 Should You Buy Before The April 17 Deadline

Apr 07, 2025

Top Ai Stock Down 25 Should You Buy Before The April 17 Deadline

Apr 07, 2025 -

Hamster Kombats Anniversary The State Of Web3 Gaming One Year On

Apr 07, 2025

Hamster Kombats Anniversary The State Of Web3 Gaming One Year On

Apr 07, 2025 -

Britney Spears Honest Account Of Her Life Following Sam Asghari Separation

Apr 07, 2025

Britney Spears Honest Account Of Her Life Following Sam Asghari Separation

Apr 07, 2025 -

Hama Tikus Di Ikn Fakta Terbaru Dan Upaya Penanggulangan Dari Otorita Ibu Kota Nusantara

Apr 07, 2025

Hama Tikus Di Ikn Fakta Terbaru Dan Upaya Penanggulangan Dari Otorita Ibu Kota Nusantara

Apr 07, 2025