Trump Stock Soars 12% Amidst Whale Accumulation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump Stock Soars 12% Amidst Whale Accumulation: Is This Just the Beginning?

Donald Trump's comeback trail has taken an unexpected turn, not on the political stage, but in the financial markets. Shares of the Trump-branded company, [specify the exact company name here, e.g., Trump Organization Holdings], experienced a dramatic surge, soaring a remarkable 12% in a single trading session. This significant jump has sparked intense speculation, with analysts pointing towards a potential "whale accumulation" – large-scale buying by institutional investors. But is this a fleeting rally, or the start of a sustained upward trend?

This unprecedented surge comes at a critical juncture for the former president, amidst ongoing legal battles and his continued influence on the Republican party. The market's positive reaction suggests a level of investor confidence, defying the prevailing narrative surrounding his legal challenges.

The Whale Theory: Institutional Investors Bet Big on Trump

The 12% jump wasn't fueled by retail investors alone. Evidence suggests significant activity from institutional investors, often referred to as "whales" due to their immense buying power. These large-scale purchases signal a belief in the company's future prospects, potentially indicating a long-term investment strategy. Several factors could be contributing to this bullish sentiment:

- Political resurgence: Despite his legal challenges, Trump remains a powerful force in the Republican party, suggesting a continued influence on policy and potentially lucrative business opportunities.

- Brand loyalty: The Trump brand, while controversial, retains a significant level of loyalty among a dedicated consumer base. This customer loyalty translates into consistent revenue streams, attracting investors seeking stable returns.

- Strategic acquisitions: Speculation abounds regarding potential acquisitions or mergers that could significantly boost the company's value. These unconfirmed rumors are fueling the current market excitement.

- Market undervaluation: Some analysts argue that the market had previously undervalued the company's assets and potential, creating an opportunity for shrewd investors to capitalize on a perceived bargain.

What Does This Mean for Investors?

The recent surge presents a complex picture for potential investors. While the 12% jump is undeniably impressive, it’s crucial to approach this situation cautiously. This significant increase may represent a short-term rally, potentially influenced by speculation and market sentiment rather than fundamental company performance.

Before making any investment decisions, investors should consider:

- Fundamental analysis: A thorough assessment of the company's financial health, including revenue streams, debt levels, and profitability, is crucial.

- Risk assessment: Investing in companies associated with highly publicized figures like Donald Trump inherently carries a higher level of risk due to the unpredictable nature of political and legal landscapes.

- Diversification: It's vital to diversify your investment portfolio to mitigate risk and avoid over-reliance on a single asset.

Conclusion: Cautious Optimism?

The 12% surge in Trump stock amidst reports of whale accumulation has undoubtedly captured market attention. While the reasons behind this jump are multifaceted, ranging from political influence to perceived undervaluation, investors must approach this situation with a balanced perspective. Thorough due diligence, a careful consideration of risks, and a diversified investment strategy are paramount before engaging with this volatile asset. Only time will tell if this represents a genuine long-term turnaround or merely a temporary market fluctuation. Further developments in Trump's legal battles and the company's strategic moves will be key factors influencing future stock performance. Stay tuned for further updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump Stock Soars 12% Amidst Whale Accumulation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Indiana Pacers Win Game 1 Haliburtons Impact

May 23, 2025

Indiana Pacers Win Game 1 Haliburtons Impact

May 23, 2025 -

P A Decision Prise La Tournee Est Confirmee

May 23, 2025

P A Decision Prise La Tournee Est Confirmee

May 23, 2025 -

Trump Administrations Harvard Lawsuit What It Means For International Students Future

May 23, 2025

Trump Administrations Harvard Lawsuit What It Means For International Students Future

May 23, 2025 -

Analyzing The Polkadot Dot Price Decline A Technical Perspective

May 23, 2025

Analyzing The Polkadot Dot Price Decline A Technical Perspective

May 23, 2025 -

Denzel Washington Cannes Controversy Official Response From His Publicist

May 23, 2025

Denzel Washington Cannes Controversy Official Response From His Publicist

May 23, 2025

Latest Posts

-

World First Petahertz Speed Phototransistor Functions At Room Temperature

May 24, 2025

World First Petahertz Speed Phototransistor Functions At Room Temperature

May 24, 2025 -

Haedal Haedal On Sui 100 Million Trading Volume After Binance Listing Speculation

May 24, 2025

Haedal Haedal On Sui 100 Million Trading Volume After Binance Listing Speculation

May 24, 2025 -

Us Governments Decision On Harvard And Foreign Students Implications And Analysis

May 24, 2025

Us Governments Decision On Harvard And Foreign Students Implications And Analysis

May 24, 2025 -

Revenge Is A Dish Best Served Debated Netflix Thrillers Polarizing Reception

May 24, 2025

Revenge Is A Dish Best Served Debated Netflix Thrillers Polarizing Reception

May 24, 2025 -

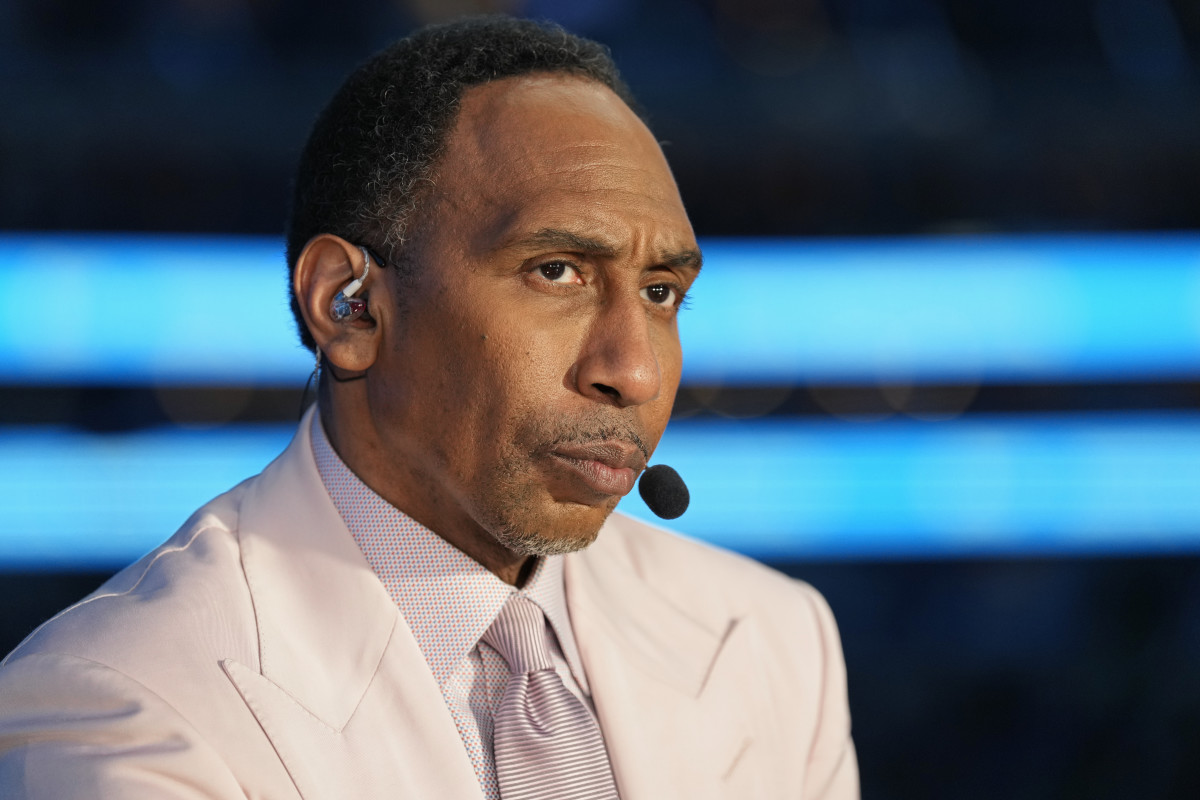

Stephen A Smiths Outrage Cnn Anchors Actions Condemned

May 24, 2025

Stephen A Smiths Outrage Cnn Anchors Actions Condemned

May 24, 2025