Trump's Return Fuels Recession Concerns: Wall Street Sell-Off Intensifies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's Return Fuels Recession Concerns: Wall Street Sell-Off Intensifies

Former President Donald Trump's re-entry into the political arena has sent shockwaves through Wall Street, intensifying fears of an impending recession. The announcement of his 2024 presidential bid triggered a significant sell-off, leaving investors jittery about the economic implications of a potential Trump presidency. This follows months of rising inflation and interest rate hikes by the Federal Reserve, creating a volatile and uncertain market environment.

The stock market downturn is not solely attributable to Trump's announcement, but his return undoubtedly exacerbated existing anxieties. Analysts point to several key factors contributing to the heightened recessionary concerns:

Uncertainty and Policy Volatility

Trump's previous administration was marked by significant policy shifts and unpredictable trade decisions. The prospect of a similar approach in a second term is causing investors to reassess their portfolios. Uncertainties surrounding future trade policies, regulatory changes, and fiscal spending plans are contributing to market instability. This uncertainty creates a climate of risk aversion, prompting investors to seek safer, less volatile investments.

Inflationary Pressures and Interest Rates

The ongoing battle against inflation remains a major concern. While the Federal Reserve has aggressively raised interest rates to combat rising prices, there are growing concerns about the potential for a recessionary spiral. Higher interest rates, while aimed at curbing inflation, can also stifle economic growth by increasing borrowing costs for businesses and consumers. Trump's past economic policies, some argue, could further exacerbate these inflationary pressures.

Geopolitical Instability

Trump's foreign policy stances are another factor influencing investor sentiment. His "America First" approach and unpredictable interactions with international allies have raised concerns about potential disruptions to global trade and supply chains. Geopolitical instability, coupled with domestic economic uncertainty, creates a perfect storm for investor anxiety. The current global landscape already faces numerous challenges, and a Trump presidency could amplify existing risks.

Market Reactions and Expert Opinions

The immediate market reaction to Trump's announcement was a sharp decline in major stock indices. This sell-off reflects investors' nervousness about the future direction of the US economy under a potential Trump administration. Several leading economists have expressed concerns about the potential for increased economic volatility and slower growth under a Trump presidency. Some analysts predict a prolonged period of market instability until there is greater clarity on Trump's economic policies and their potential impact.

Key takeaways:

- Trump's return amplified pre-existing recession fears. The market was already grappling with inflation and interest rate hikes.

- Policy uncertainty is a major driver of the sell-off. Investors are concerned about potential shifts in trade, regulation, and fiscal policy.

- Inflation and interest rates remain significant headwinds for the economy. The Fed's actions to combat inflation could inadvertently trigger a recession.

- Geopolitical risks are further contributing to market volatility. Trump's foreign policy stances could destabilize global trade and supply chains.

The coming months will be crucial in determining the full economic impact of Trump's return to the political stage. The market will closely scrutinize his policy pronouncements and any potential shifts in his economic platform. The path ahead remains uncertain, but one thing is clear: Trump's re-emergence has injected a significant dose of volatility into an already fragile economic landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump's Return Fuels Recession Concerns: Wall Street Sell-Off Intensifies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

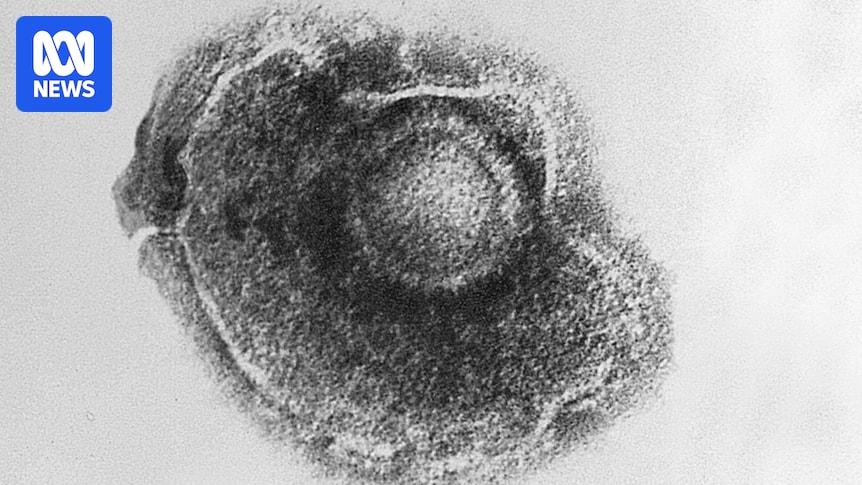

Understanding The Viral Dementia Connection What Scientists Are Discovering

Apr 22, 2025

Understanding The Viral Dementia Connection What Scientists Are Discovering

Apr 22, 2025 -

Square Xs B Sides San Francisco Presentation A Critical Look At Data Splicing Attacks And Dlp Failures

Apr 22, 2025

Square Xs B Sides San Francisco Presentation A Critical Look At Data Splicing Attacks And Dlp Failures

Apr 22, 2025 -

Us Tariffs Spur Chinese Electric Vehicle Investment In The Uk

Apr 22, 2025

Us Tariffs Spur Chinese Electric Vehicle Investment In The Uk

Apr 22, 2025 -

Michael Slaters Plea Australian Cricketer Awaits Sentencing Today

Apr 22, 2025

Michael Slaters Plea Australian Cricketer Awaits Sentencing Today

Apr 22, 2025 -

Experience Smoother Listening You Tube Musics Volume Control Upgrade

Apr 22, 2025

Experience Smoother Listening You Tube Musics Volume Control Upgrade

Apr 22, 2025