Two-Year, $1 Billion Compliance Spending Spree For TD Bank

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

TD Bank's $1 Billion Compliance Spending Spree: Two Years of Overhaul

TD Bank Group, a major player in the North American financial landscape, has embarked on a significant two-year, $1 billion investment in bolstering its compliance infrastructure. This massive spending spree underscores the growing pressure on financial institutions to strengthen their regulatory adherence and risk management practices in an increasingly complex regulatory environment. The move signals a proactive approach to mitigating potential risks and maintaining a strong reputation in the face of heightened scrutiny.

What Drove the Massive Investment?

The investment isn't a random expenditure; it's a strategic response to several key factors:

-

Heightened Regulatory Scrutiny: Financial institutions globally are facing increased regulatory oversight and enforcement actions. This includes stricter compliance requirements related to anti-money laundering (AML), know your customer (KYC), and sanctions compliance. TD Bank's investment reflects a commitment to proactively address these challenges.

-

Technological Advancements: The financial technology (fintech) landscape is evolving rapidly, necessitating ongoing upgrades to compliance systems. This includes investing in advanced analytics, artificial intelligence (AI), and machine learning (ML) to detect and prevent financial crime more effectively. The $1 billion investment likely includes significant upgrades to their technological infrastructure.

-

Cybersecurity Threats: The increasing sophistication of cyberattacks targeting financial institutions necessitates substantial investments in cybersecurity measures. Robust cybersecurity is not merely a technical issue; it's a crucial part of compliance, protecting customer data and maintaining operational integrity. This aspect likely represents a substantial portion of the overall expenditure.

-

Reputation Management: Maintaining a strong reputation is paramount for any financial institution. Proactive compliance measures help to avoid costly fines, legal battles, and reputational damage associated with regulatory breaches. TD Bank's investment demonstrates a clear commitment to prioritizing reputation management.

Beyond the Numbers: A Deeper Dive into the Strategy

While the $1 billion figure is striking, the true impact lies in the specifics of TD Bank's compliance overhaul. The investment likely covers a range of initiatives, including:

- Staff Augmentation: Hiring additional compliance professionals with specialized expertise in AML, KYC, sanctions, and other regulatory areas.

- System Upgrades: Modernizing existing systems and implementing new technologies to enhance efficiency and effectiveness in compliance monitoring.

- Training and Development: Investing in comprehensive training programs for employees to ensure they understand and adhere to regulatory requirements.

- Enhanced Monitoring and Reporting: Implementing advanced monitoring tools and processes to proactively identify and address potential compliance issues.

Looking Ahead: Implications for the Industry

TD Bank's significant investment sets a precedent for other financial institutions. It highlights the growing importance of robust compliance programs and the substantial resources required to maintain them. This proactive approach is likely to become the industry standard as regulatory pressure continues to intensify and the threat landscape evolves. The long-term success of this investment will depend on the effective implementation and integration of these new systems and processes. The industry will be watching closely to see the results of TD Bank's ambitious compliance strategy.

Keywords: TD Bank, Compliance, Regulatory, AML, KYC, Sanctions, Cybersecurity, Fintech, Financial Crime, Risk Management, Investment, Spending, Technology, AI, Machine Learning, Reputation Management, Financial Institutions, Regulatory Compliance, Compliance Spending, Billion Dollar Investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two-Year, $1 Billion Compliance Spending Spree For TD Bank. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Bitcoins Recent Rise Due To Trump Investment Analysis

May 23, 2025

Is Bitcoins Recent Rise Due To Trump Investment Analysis

May 23, 2025 -

This Little Known Dating Show Is The New Love Island Tik Toks Verdict

May 23, 2025

This Little Known Dating Show Is The New Love Island Tik Toks Verdict

May 23, 2025 -

Fujifilm X Half Is This Tiny Retro Camera Worth The Hype

May 23, 2025

Fujifilm X Half Is This Tiny Retro Camera Worth The Hype

May 23, 2025 -

Kieran Culkins New Role Caesar In Hunger Games Sunrise On The Reaping Exclusive

May 23, 2025

Kieran Culkins New Role Caesar In Hunger Games Sunrise On The Reaping Exclusive

May 23, 2025 -

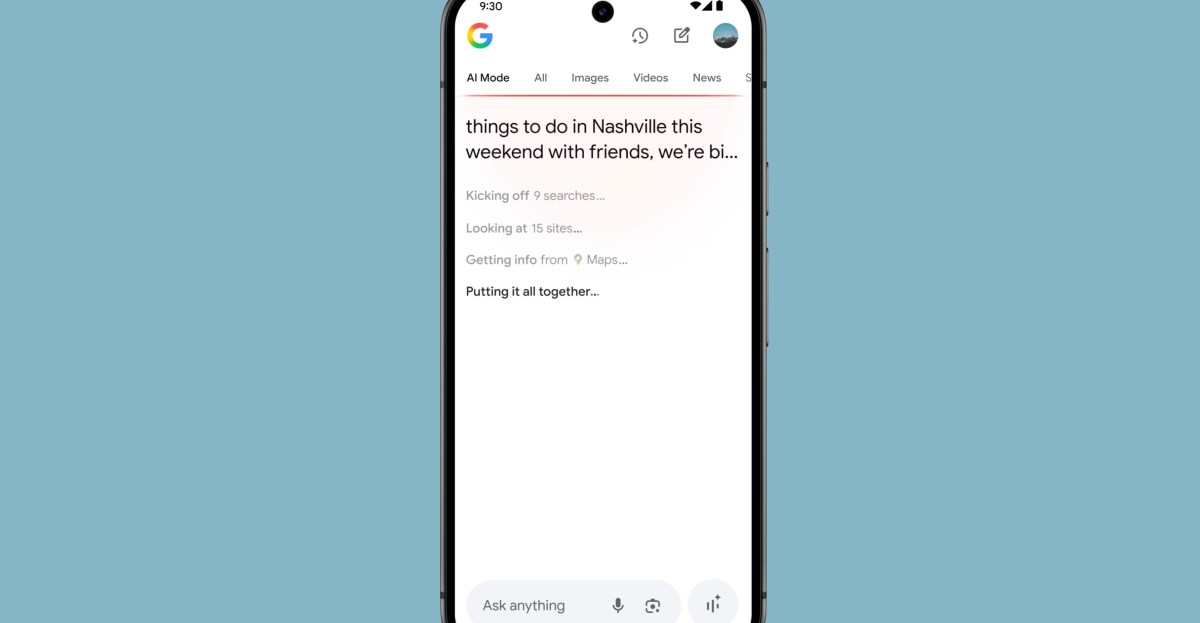

Googles Ai Mode Revolutionizing Search Or Just Another Update

May 23, 2025

Googles Ai Mode Revolutionizing Search Or Just Another Update

May 23, 2025

Latest Posts

-

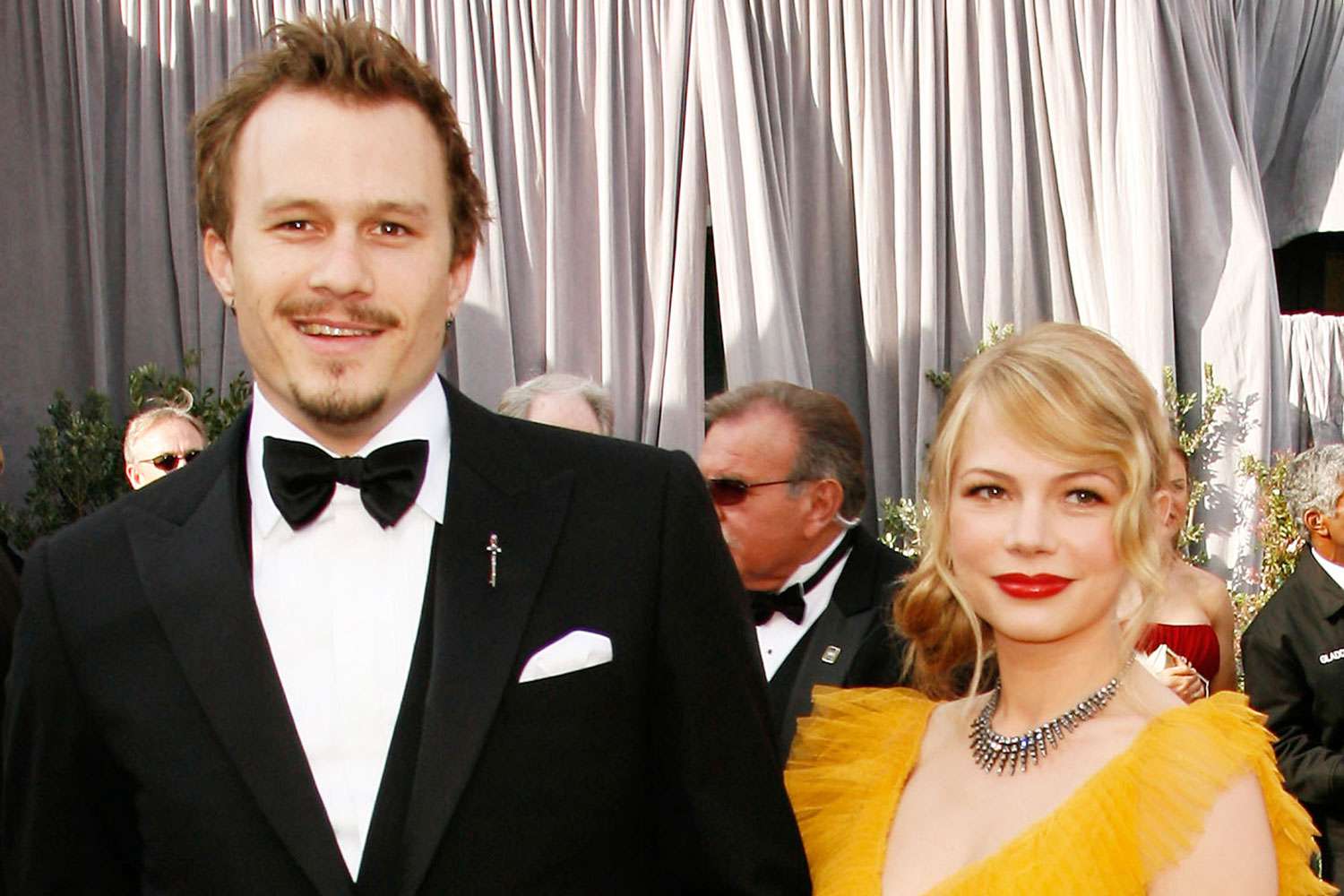

Heath Ledgers Daughter Matilda Michelle Williams Shares Poignant Reflections On Family

May 23, 2025

Heath Ledgers Daughter Matilda Michelle Williams Shares Poignant Reflections On Family

May 23, 2025 -

Woodlands And Tuas Checkpoints Ica Advises Travelers To Prepare For Heavy Traffic This June

May 23, 2025

Woodlands And Tuas Checkpoints Ica Advises Travelers To Prepare For Heavy Traffic This June

May 23, 2025 -

Nhl Forward Tom Eisenhuth Retires Due To Persistent Injuries

May 23, 2025

Nhl Forward Tom Eisenhuth Retires Due To Persistent Injuries

May 23, 2025 -

Hulus Upcoming Zombie Film 18 Year Olds Fight The Undead

May 23, 2025

Hulus Upcoming Zombie Film 18 Year Olds Fight The Undead

May 23, 2025 -

First Successful Flight Test Venus Aerospaces Revolutionary Rde Engine

May 23, 2025

First Successful Flight Test Venus Aerospaces Revolutionary Rde Engine

May 23, 2025