U.S. Energy Markets React: EIA Announces Unexpected Build In Crude Oil And Fuel Inventories

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Energy Markets React: EIA Announces Unexpected Build in Crude Oil and Fuel Inventories

Surprise Inventory Surge Shakes Up Energy Markets

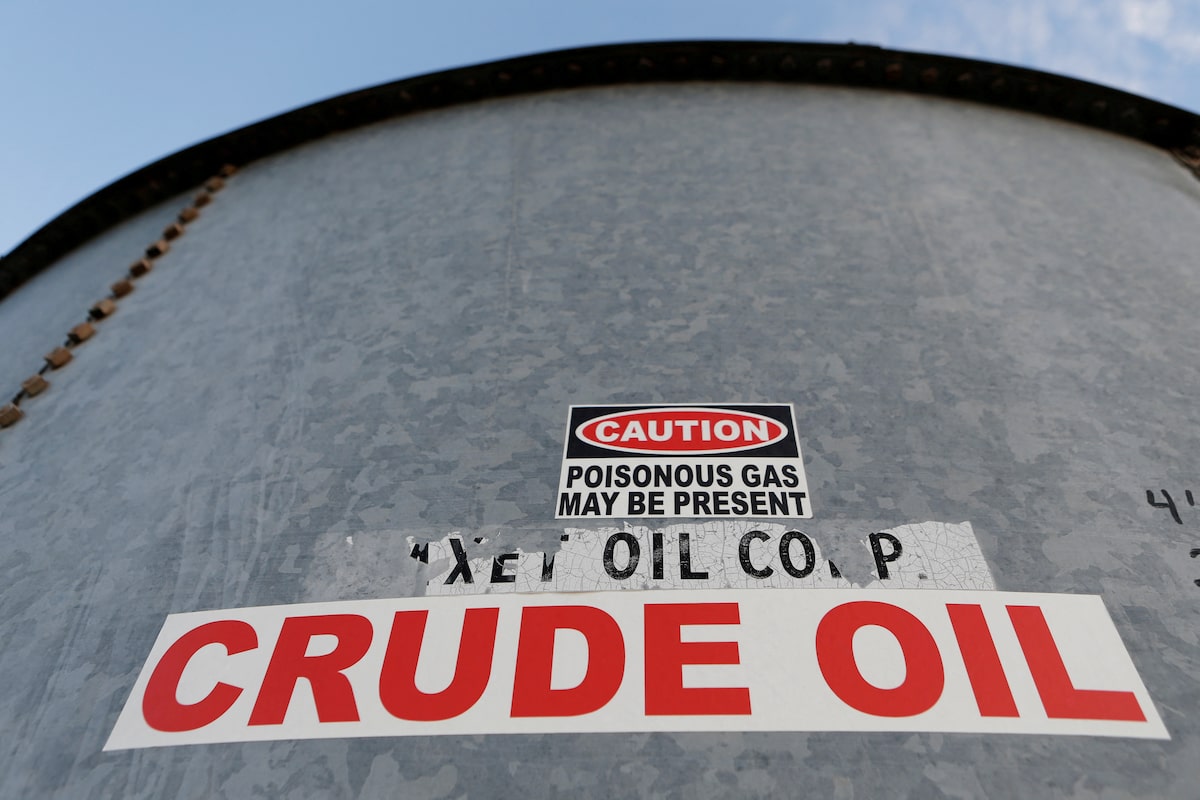

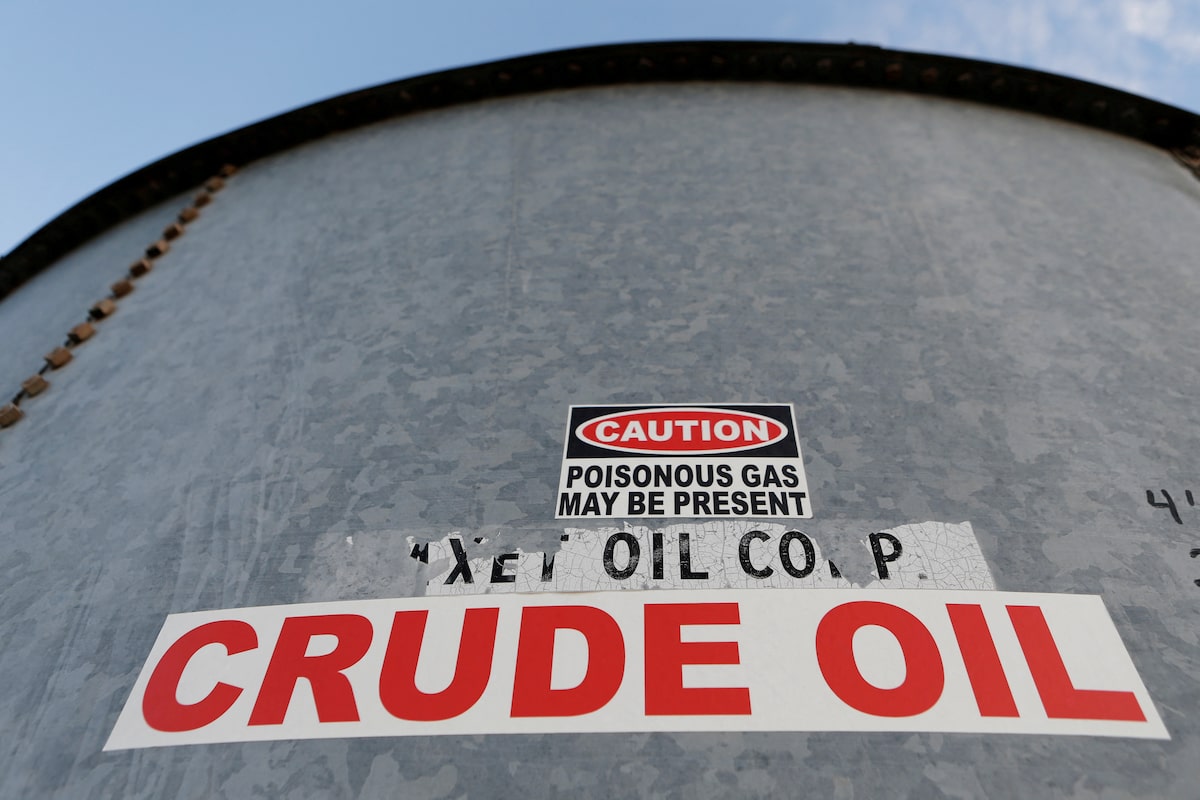

The U.S. energy market experienced a significant jolt this week following the Energy Information Administration's (EIA) announcement of an unexpected build in crude oil and fuel inventories. The report, released [Date of Release], revealed a larger-than-anticipated increase in crude oil stocks, defying analysts' predictions and sending ripples through the market. This unexpected development has raised questions about the future trajectory of oil prices and the overall health of the U.S. energy sector.

Key Findings from the EIA Report:

The EIA report highlighted several key factors contributing to the inventory build:

- Higher-than-expected imports: A surge in crude oil imports played a significant role in the inventory increase, exceeding market expectations.

- Reduced refinery utilization: Lower-than-predicted refinery utilization rates contributed to a slower pace of crude oil processing, leading to a build-up of inventories.

- Shifting demand patterns: Changes in gasoline and distillate fuel demand, potentially influenced by seasonal factors or economic conditions, also impacted inventory levels. The report specifically noted [mention specific details from the report about gasoline and distillate fuel demand].

Market Reaction and Price Volatility:

The EIA's announcement immediately triggered a wave of volatility in the energy markets. Crude oil futures prices experienced a [Percentage]% drop following the release, reflecting the market's reaction to the unexpected inventory build. This price fluctuation impacted related sectors, including gasoline and other refined petroleum products. Traders and analysts are now closely scrutinizing the implications of this development for future price projections.

Impact on Oil Prices and Future Outlook:

The unexpected inventory increase raises concerns about the balance between supply and demand in the U.S. energy market. While some analysts believe this is a temporary anomaly, others suggest it could signal a weakening in demand or an oversupply situation. The uncertainty surrounding future oil prices is further exacerbated by [mention geopolitical factors, such as OPEC+ decisions or global economic uncertainty].

Looking Ahead: What to Watch For

Several key factors will influence the market's trajectory in the coming weeks and months:

- OPEC+ decisions: The actions of the Organization of the Petroleum Exporting Countries and its allies (OPEC+) will significantly impact global oil supply and prices.

- Global economic growth: Economic growth projections in major consuming countries will play a critical role in shaping future demand for oil and refined products.

- Refinery operations: Changes in refinery utilization rates and operational efficiency will directly affect the pace of crude oil processing and inventory levels.

- Seasonal demand: As we move into [mention upcoming season, e.g., the fall and winter driving season], seasonal shifts in fuel demand will influence inventory levels and price dynamics.

Conclusion: Uncertainty and the Path Forward

The EIA's unexpected inventory report has injected significant uncertainty into the U.S. energy market. While the immediate impact has been a price decline, the long-term consequences remain unclear. Close monitoring of the factors outlined above will be crucial for understanding the market's future trajectory and navigating the volatility ahead. The energy market remains a dynamic landscape, and investors and consumers alike should stay informed about the latest developments.

Keywords: EIA, Energy Information Administration, Crude Oil, Fuel Inventories, Oil Prices, U.S. Energy Market, Inventory Build, OPEC+, Refinery Utilization, Gasoline Demand, Distillate Fuel, Energy Sector, Market Volatility, Oil Futures, Supply and Demand.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Energy Markets React: EIA Announces Unexpected Build In Crude Oil And Fuel Inventories. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Silence Broken Marners Mother Addresses Criticism And Maple Leafs Future

May 23, 2025

Silence Broken Marners Mother Addresses Criticism And Maple Leafs Future

May 23, 2025 -

Dell Ceo Rejects Ai Job Displacement Highlights Productivity Gains

May 23, 2025

Dell Ceo Rejects Ai Job Displacement Highlights Productivity Gains

May 23, 2025 -

Secs Peirce The Case Against Classifying Most Nfts Including Creator Funded Projects As Securities

May 23, 2025

Secs Peirce The Case Against Classifying Most Nfts Including Creator Funded Projects As Securities

May 23, 2025 -

Unexpected Knicks Advantage How They Could Clinch The Series Against The Pacers

May 23, 2025

Unexpected Knicks Advantage How They Could Clinch The Series Against The Pacers

May 23, 2025 -

Cine De Aventura Y Ciencia Ficcion Localizaciones En Bangkok Y Egipto

May 23, 2025

Cine De Aventura Y Ciencia Ficcion Localizaciones En Bangkok Y Egipto

May 23, 2025

Latest Posts

-

New Footage Reveals Sounds Of The Ocean Gate Titan Sub Imploding

May 23, 2025

New Footage Reveals Sounds Of The Ocean Gate Titan Sub Imploding

May 23, 2025 -

Wall Street Meets Blockchain Krakens Launch Of Onchain Tokenized Equities

May 23, 2025

Wall Street Meets Blockchain Krakens Launch Of Onchain Tokenized Equities

May 23, 2025 -

Sui Based Haedal Sees Meteoric Rise 100 M Traded Amidst Binance Listing Buzz

May 23, 2025

Sui Based Haedal Sees Meteoric Rise 100 M Traded Amidst Binance Listing Buzz

May 23, 2025 -

Woodlands And Tuas Checkpoint Congestion Expected During June School Holidays Ica Warning

May 23, 2025

Woodlands And Tuas Checkpoint Congestion Expected During June School Holidays Ica Warning

May 23, 2025 -

Geneva Open Novak Djokovic Reaches Semifinals On His Birthday

May 23, 2025

Geneva Open Novak Djokovic Reaches Semifinals On His Birthday

May 23, 2025