Urgent: IRS Announces Significant Tax Law Changes Before Tax Day

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Urgent: IRS Announces Significant Tax Law Changes Before Tax Day

Taxpayers scramble as the IRS announces last-minute changes to tax laws just days before the April 18th deadline. The Internal Revenue Service (IRS) dropped a bombshell announcement late Tuesday, revealing significant alterations to several key tax provisions, leaving millions of Americans scrambling to adjust their filings before the rapidly approaching tax day. This unexpected development has created widespread confusion and sparked outrage among taxpayers and tax professionals alike.

This article will break down the key changes announced by the IRS, offering crucial information to help you navigate this complex and stressful situation.

Key Changes Announced by the IRS:

The IRS announcement focuses primarily on adjustments to:

- Standard Deduction Adjustments: The standard deduction for single filers has been unexpectedly increased by $500, while the standard deduction for married couples filing jointly has been raised by $1000. This late change impacts millions and requires many to re-evaluate their filings.

- Child Tax Credit Modifications: Several modifications have been made to the Child Tax Credit (CTC), including changes to the age limits and income thresholds. The IRS website provides detailed clarification on these specific alterations, but taxpayers are urged to double-check their eligibility. Failure to account for these changes could result in significant penalties.

- Qualified Business Income (QBI) Deduction Adjustments: The QBI deduction, crucial for many small business owners and self-employed individuals, has undergone modifications. Specific adjustments to income limits and eligible business types were included in the announcement. Tax professionals are advising clients to review these adjustments carefully.

What Should Taxpayers Do?

The sudden nature of these changes presents a significant challenge for taxpayers. Here's what you should do:

- Visit the IRS Website: The official IRS website is the best source of accurate, up-to-date information. Look for official press releases and FAQs regarding these recent changes.

- Consult a Tax Professional: If you are unsure how these changes affect your tax return, seek professional guidance from a qualified tax advisor. They can help you navigate the complexities and ensure you file accurately.

- File an Amended Return (if necessary): If you've already filed and the changes significantly impact your return, you may need to file an amended return (Form 1040-X). The IRS website provides detailed instructions.

- Request an Extension (if needed): While unlikely to fully resolve the issue, an extension can provide additional time to gather necessary information and adjust your return accurately. However, remember that this only extends the filing deadline, not the payment deadline.

Understanding the Impact:

These last-minute changes highlight the importance of staying informed about tax laws throughout the tax season. Many taxpayers are frustrated and concerned about the potential for errors and penalties. The IRS has stated it will provide assistance, but the sheer volume of affected taxpayers creates concern about potential processing delays.

The Future of Tax Law Changes:

This unexpected event underscores the need for greater transparency and predictability in tax law changes. Experts are calling for reforms to the process to prevent similar situations in the future. The impact on taxpayer confidence and trust in the IRS remains to be seen.

Keywords: IRS, Tax Day, Tax Law Changes, Tax Return, Amended Return, Standard Deduction, Child Tax Credit, QBI Deduction, April 18th, Tax Filing, Tax Professionals, Tax Season, Income Tax, Tax Reform

This news article provides factual information and aims to help readers understand the recent changes in tax laws. Always consult official sources and professionals for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Urgent: IRS Announces Significant Tax Law Changes Before Tax Day. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Solana Sol Tanks 23 Reaching Oversold Levels Traders Await Price Reversal

Apr 08, 2025

Solana Sol Tanks 23 Reaching Oversold Levels Traders Await Price Reversal

Apr 08, 2025 -

Investing 1000 In United Health Group 2013 Vs 2023

Apr 08, 2025

Investing 1000 In United Health Group 2013 Vs 2023

Apr 08, 2025 -

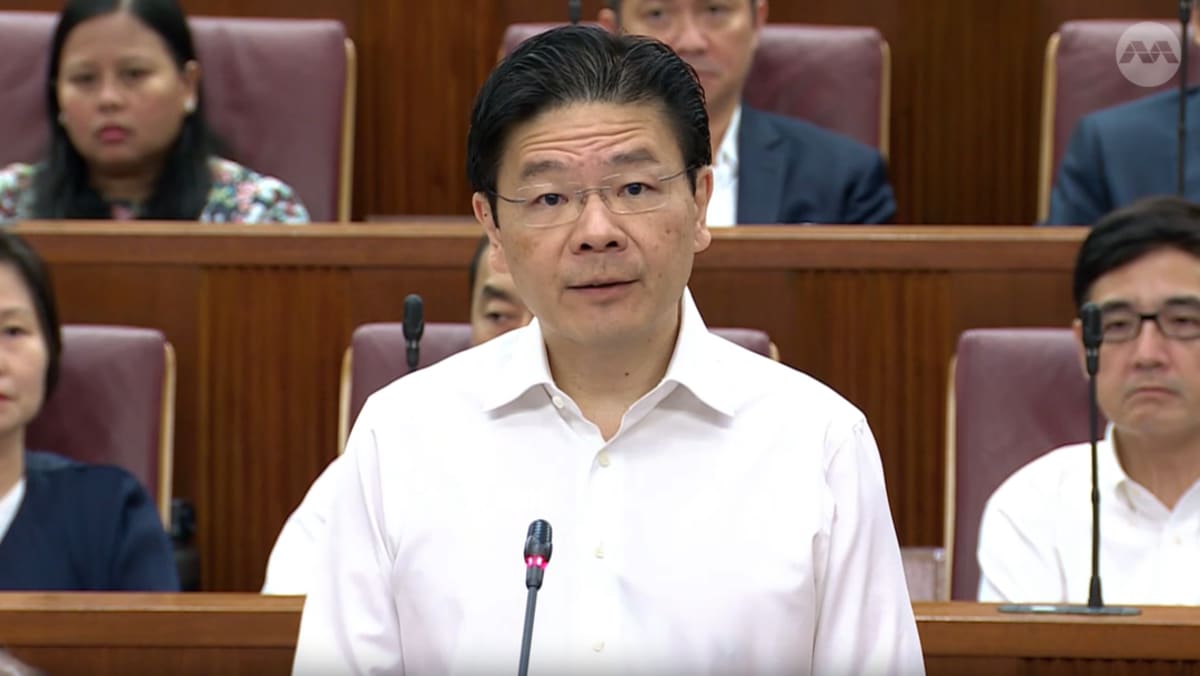

Trump Tariff Impact Singapore Government Forms Task Force To Aid Businesses And Workers

Apr 08, 2025

Trump Tariff Impact Singapore Government Forms Task Force To Aid Businesses And Workers

Apr 08, 2025 -

Analyzing Space X Starships Potential For Global Cargo And Fuel Market Disruption

Apr 08, 2025

Analyzing Space X Starships Potential For Global Cargo And Fuel Market Disruption

Apr 08, 2025 -

Standard Chartereds Share Buyback 891 878 Shares Acquired On April 3rd

Apr 08, 2025

Standard Chartereds Share Buyback 891 878 Shares Acquired On April 3rd

Apr 08, 2025