US Banking Giants Secretly Develop Shared Stablecoin

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Banking Giants Secretly Develop Shared Stablecoin: A New Era of Financial Innovation or Regulatory Nightmare?

The US banking industry is quietly revolutionizing the financial landscape. Multiple sources confirm that a consortium of major US banking giants has been secretly collaborating on a shared stablecoin project, potentially reshaping the future of digital payments and financial transactions. While details remain scarce, the implications of this development are far-reaching, sparking both excitement and apprehension among experts and regulators alike.

A Consortium of Power: Who's Involved?

While the specific names of participating banks remain undisclosed under strict non-disclosure agreements (NDAs), industry insiders suggest the initiative involves some of the largest and most influential financial institutions in the United States. This level of secrecy points to a potentially game-changing technology and a desire to maintain a competitive edge before official announcements. The mystery surrounding the project's participants only fuels speculation and increases the anticipation for its eventual unveiling.

The Allure of a Shared Stablecoin:

The potential advantages of a shared stablecoin are considerable. A system backed by a consortium of established banks could offer:

- Enhanced Trust and Stability: The backing of multiple major institutions could significantly increase user trust compared to single-entity stablecoins, mitigating the risk of collapses like we've seen in the past.

- Increased Accessibility: A widely adopted stablecoin could broaden access to financial services, particularly for underserved communities.

- Streamlined Transactions: Faster, cheaper, and more efficient cross-border payments could revolutionize international trade and commerce.

- Reduced Transaction Fees: The potential for lower transaction fees compared to traditional banking systems could benefit both businesses and consumers.

Regulatory Hurdles and Potential Risks:

However, the path to a successful launch isn't without obstacles. The project faces significant regulatory challenges:

- Compliance with Existing Regulations: Navigating the complex regulatory landscape surrounding digital assets and stablecoins in the US will be crucial for the project's success. Compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations will be paramount.

- Competition and Antitrust Concerns: The collaboration between such powerful financial institutions raises potential antitrust concerns that will need careful consideration.

- Data Privacy Concerns: Protecting user data and ensuring compliance with privacy regulations will be a major challenge.

The Future of Finance: A Paradigm Shift?

This clandestine development marks a potential paradigm shift in the US financial system. The success of this shared stablecoin project could accelerate the adoption of digital currencies and transform how we conduct financial transactions. Conversely, failure could reinforce skepticism surrounding cryptocurrencies and stifle innovation. The coming months will be crucial in revealing the full details of this project and its impact on the broader financial landscape.

Keywords: US banking, stablecoin, digital currency, cryptocurrency, financial innovation, regulatory challenges, fintech, blockchain technology, payments, transactions, banking consortium, AML, KYC, antitrust.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Banking Giants Secretly Develop Shared Stablecoin. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Solana Sol Technical Analysis Could 200 Be Within Reach

May 25, 2025

Solana Sol Technical Analysis Could 200 Be Within Reach

May 25, 2025 -

Robert Pattinson In A 131 Million Space Comedy A Hilarious Multi Role Performance

May 25, 2025

Robert Pattinson In A 131 Million Space Comedy A Hilarious Multi Role Performance

May 25, 2025 -

James Martin Condemns London Crime Spree After Car Vandalism

May 25, 2025

James Martin Condemns London Crime Spree After Car Vandalism

May 25, 2025 -

New Chrono Odyssey Dev Diary Showcases In Depth Game Features

May 25, 2025

New Chrono Odyssey Dev Diary Showcases In Depth Game Features

May 25, 2025 -

Is Colorectal Cancer Affecting Younger Generations More A Look At The Statistics And Potential Causes

May 25, 2025

Is Colorectal Cancer Affecting Younger Generations More A Look At The Statistics And Potential Causes

May 25, 2025

Latest Posts

-

Could Solana Sol Reach 200 Examining The Technical Setup

May 25, 2025

Could Solana Sol Reach 200 Examining The Technical Setup

May 25, 2025 -

Moodeng Price Soars Post Robinhood Listing Breakout Potential

May 25, 2025

Moodeng Price Soars Post Robinhood Listing Breakout Potential

May 25, 2025 -

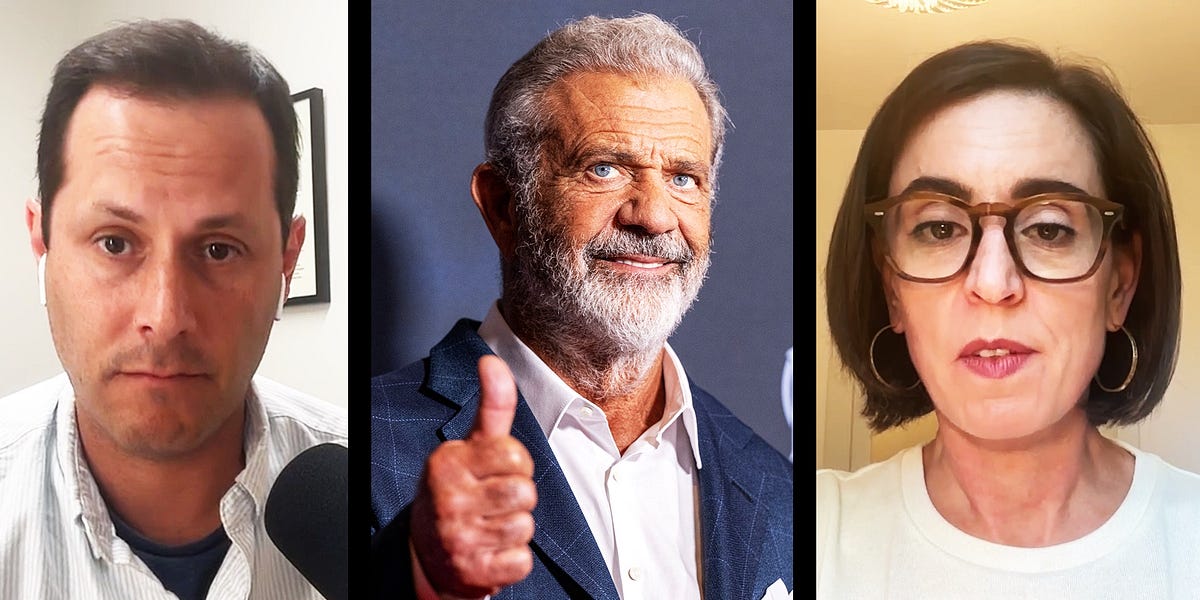

Mel Gibson Guns And A Trump Firing The Untold Story

May 25, 2025

Mel Gibson Guns And A Trump Firing The Untold Story

May 25, 2025 -

Acoes Que Pagam Dividendos Eletrobras Caixa Seguridade E As Principais Da Semana

May 25, 2025

Acoes Que Pagam Dividendos Eletrobras Caixa Seguridade E As Principais Da Semana

May 25, 2025 -

Lawrence Livermore National Lab Reports 4x Energy Gain In Laser Fusion Experiment

May 25, 2025

Lawrence Livermore National Lab Reports 4x Energy Gain In Laser Fusion Experiment

May 25, 2025