USD/ZAR Exchange Rate Forecast: April 21st, 2024 Low Volume Impact

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

USD/ZAR Exchange Rate Forecast: April 21st, 2024 - Low Volume Impact Shakes the Market

The USD/ZAR exchange rate experienced unusual volatility on April 21st, 2024, largely attributed to unusually low trading volume. This unexpected fluctuation has left analysts scrambling to understand the underlying causes and predict future movement. While a definitive forecast remains elusive, understanding the impact of low volume is crucial for navigating this volatile market.

Low Volume: A Catalyst for Volatility

Low trading volume often amplifies price swings. With fewer trades executed, even small orders can disproportionately impact the price. This "thin market" effect was clearly evident on April 21st. What might have been a minor adjustment in a more active market resulted in a significant, albeit short-lived, shift in the USD/ZAR exchange rate.

Factors Contributing to Low Volume:

Several factors likely contributed to the low trading volume observed on April 21st. These include:

- Public Holidays: A global or regional holiday could have reduced participation from key players in the forex market.

- Geopolitical Uncertainty: Heightened geopolitical tensions can lead to investors adopting a "wait-and-see" approach, reducing trading activity.

- Economic Data Releases: The absence of significant economic data releases could have dampened trading interest. Predictable markets often see reduced volume.

- Seasonal Factors: Certain times of the year naturally experience lower trading volumes.

USD/ZAR Exchange Rate Forecast: Navigating Uncertainty

Predicting the USD/ZAR exchange rate with complete accuracy is impossible, especially in the aftermath of an unusually volatile day driven by low volume. However, several key factors will influence the future movement:

- South African Economic Data: Upcoming releases of key economic indicators like inflation figures, GDP growth, and interest rate decisions will significantly affect the ZAR's strength. Positive economic data will generally strengthen the Rand.

- US Monetary Policy: The Federal Reserve's decisions regarding interest rates will heavily influence the USD's value. Higher interest rates in the US generally attract foreign investment, strengthening the dollar.

- Global Market Sentiment: Overall investor sentiment towards emerging markets, including South Africa, will play a vital role. Positive sentiment boosts the Rand, while negative sentiment weighs it down.

- Geopolitical Events: Ongoing geopolitical developments, both globally and within South Africa, will continue to create uncertainty and impact the exchange rate.

What this Means for Traders:

The events of April 21st serve as a stark reminder of the risks associated with low-volume trading. Traders should exercise increased caution and:

- Employ tighter stop-loss orders: This minimizes potential losses during sudden price swings.

- Increase position sizing awareness: Low volume increases the risk of slippage and larger price movements.

- Diversify investments: Reducing concentration in a single asset class mitigates risk.

- Stay informed: Closely monitoring economic data releases and geopolitical developments is crucial.

Conclusion:

The low volume impact on the USD/ZAR exchange rate on April 21st, 2024, highlighted the inherent volatility of thin markets. While a precise forecast remains challenging, understanding the underlying factors and implementing risk management strategies is crucial for navigating this dynamic currency pair. Traders should remain vigilant and adapt their strategies to account for the inherent uncertainties of the global economic landscape. Stay tuned for further updates as the market evolves.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on USD/ZAR Exchange Rate Forecast: April 21st, 2024 Low Volume Impact. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tina Knowles Shares Heartbreaking Story Of Brothers Police Beating

Apr 25, 2025

Tina Knowles Shares Heartbreaking Story Of Brothers Police Beating

Apr 25, 2025 -

Ryan Papenhuyzen Cleared Bunkers Last Minute Decision

Apr 25, 2025

Ryan Papenhuyzen Cleared Bunkers Last Minute Decision

Apr 25, 2025 -

B And Os New David Bowie Speaker Design And Sound In Perfect Harmony

Apr 25, 2025

B And Os New David Bowie Speaker Design And Sound In Perfect Harmony

Apr 25, 2025 -

Ostapenkos Speed Concerns I Hope Latvian Police Arent Watching

Apr 25, 2025

Ostapenkos Speed Concerns I Hope Latvian Police Arent Watching

Apr 25, 2025 -

Nhl Games Today Tv Schedule And Live Streaming Options April 23rd

Apr 25, 2025

Nhl Games Today Tv Schedule And Live Streaming Options April 23rd

Apr 25, 2025

Latest Posts

-

Dwayne Johnsons New Photo Fans React To His Unrecognizable Look

Apr 29, 2025

Dwayne Johnsons New Photo Fans React To His Unrecognizable Look

Apr 29, 2025 -

Capital Punishment Advocacy The Case Of Luigi Mangione And The Debates Intensity

Apr 29, 2025

Capital Punishment Advocacy The Case Of Luigi Mangione And The Debates Intensity

Apr 29, 2025 -

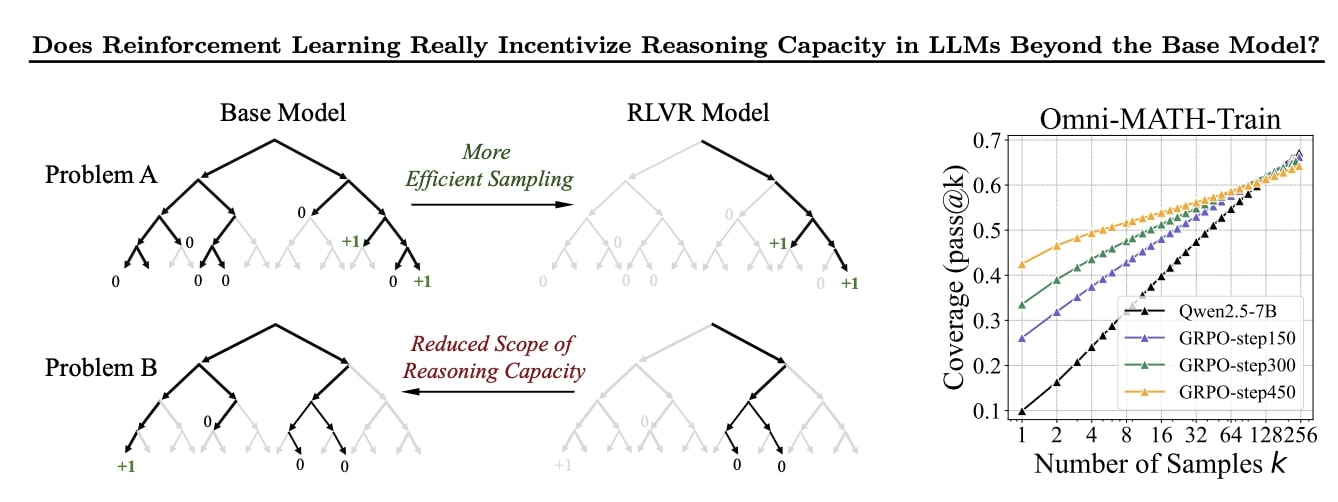

Does Reinforcement Learning Truly Enhance Ai Models A Critical Analysis

Apr 29, 2025

Does Reinforcement Learning Truly Enhance Ai Models A Critical Analysis

Apr 29, 2025 -

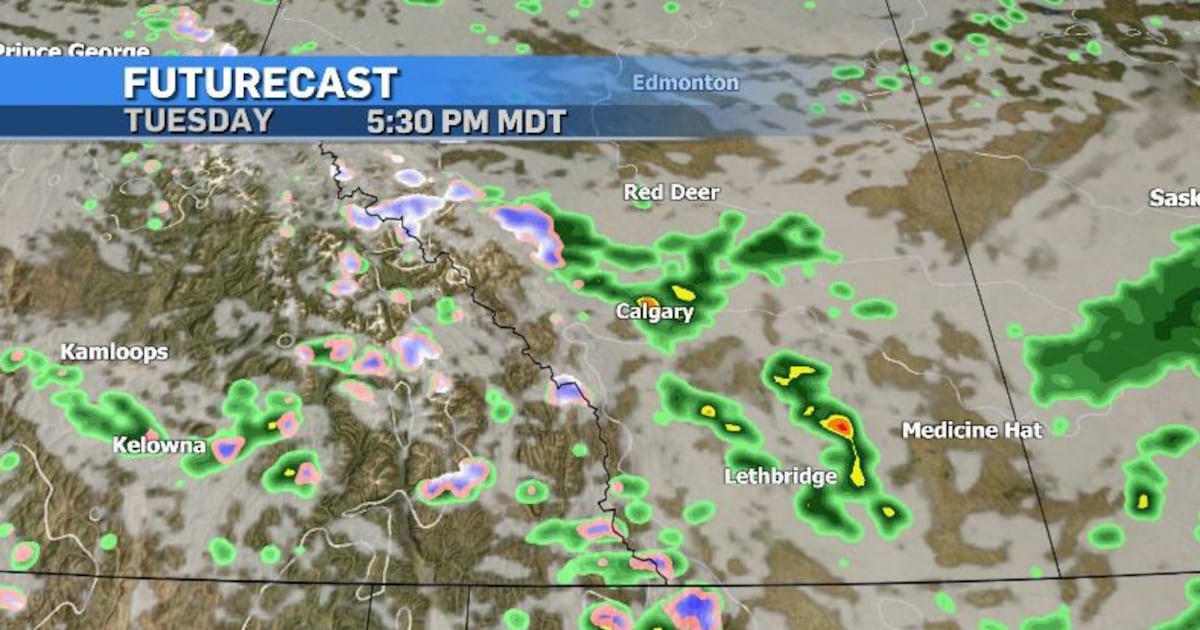

Calgary Weather Alert Cloudy Windy Thunderstorm Risk Tuesday

Apr 29, 2025

Calgary Weather Alert Cloudy Windy Thunderstorm Risk Tuesday

Apr 29, 2025 -

Analysis Trumps Partial Tariff Rollback For The Auto Industry

Apr 29, 2025

Analysis Trumps Partial Tariff Rollback For The Auto Industry

Apr 29, 2025