Warren Buffett Reduce Apple Stock: A 13% Decrease Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett Reduces Apple Stock: A 13% Decrease Explained

Oracle of Omaha's surprising move sends shockwaves through Wall Street. Warren Buffett's Berkshire Hathaway has significantly reduced its Apple stock holdings, shedding approximately 13% of its stake during the second quarter of 2023. This unexpected move has ignited intense speculation and analysis across financial markets, leaving investors questioning the future of this once-unbreakable partnership.

The news, revealed in Berkshire Hathaway's latest 13F filing, shows a decrease of roughly 8.7 million shares, a substantial reduction for a company that previously held Apple as its largest investment. While Buffett and his team haven't publicly commented on the specific reasons behind this decision, several theories have emerged, providing potential explanations for this significant shift in investment strategy.

Potential Reasons Behind the Apple Stock Reduction

Several factors could contribute to Berkshire Hathaway's decision to lessen its Apple holdings. Analyzing these factors is crucial for understanding the broader implications for both Apple and the investment landscape.

-

Market Diversification: One prominent theory suggests that Berkshire Hathaway is simply diversifying its portfolio. While Apple remains a significant holding, reducing its concentration in a single stock, no matter how successful, aligns with sound risk management principles. Diversification across various sectors is a core tenet of Buffett's investment philosophy.

-

Profit Taking: Given Apple's impressive run in recent years, it's possible that Berkshire Hathaway decided to take profits on a portion of its Apple investment. This strategy is perfectly reasonable, allowing for the reinvestment of capital into other promising opportunities. Locking in substantial gains allows for a more balanced portfolio.

-

Economic Uncertainty: The current economic climate, marked by inflation and potential recessionary pressures, might have played a role. While Apple has generally demonstrated resilience, a more cautious approach in response to economic uncertainty is not uncommon for even the most seasoned investors.

-

Internal Rebalancing: Berkshire Hathaway's vast portfolio necessitates constant rebalancing. This involves adjusting holdings to maintain a desired asset allocation. The reduction in Apple stock could simply reflect an internal rebalancing exercise aimed at optimizing the overall portfolio performance.

-

Exploration of Other Opportunities: The legendary investor might have identified more attractive investment opportunities elsewhere. Buffett is known for his patience and his ability to spot undervalued assets. The shift away from Apple might signal his conviction in other sectors.

Implications for Apple and Investors

The reduction in Berkshire Hathaway's Apple stake has understandably caused ripples in the market. While not necessarily indicative of a fundamental problem with Apple itself, it does underscore the dynamism of even the most stable investments.

-

Short-Term Volatility: The news initially led to a slight dip in Apple's stock price, highlighting the market's sensitivity to even subtle shifts in major investor positions. However, the long-term impact remains to be seen.

-

Long-Term Outlook: Most analysts believe that Apple's intrinsic value remains strong. The move by Berkshire Hathaway should not be interpreted as a sign of impending doom for Apple, but rather as a strategic repositioning by a shrewd investor.

-

Investor Sentiment: The decision has undoubtedly impacted investor sentiment. While some may see it as a bearish signal, others maintain their faith in Apple's future growth potential.

Conclusion: A Strategic Shift, Not a Condemnation

Warren Buffett's reduction of Apple stock is a significant event, sparking considerable discussion. However, it's crucial to avoid overreacting. The move likely reflects a combination of factors, including portfolio diversification, profit-taking, and potentially, the identification of more compelling investment opportunities. While the short-term market reaction is understandable, the long-term outlook for Apple remains largely positive, and the decision from Berkshire Hathaway should be seen as a strategic adjustment rather than a condemnation of the tech giant. The "Oracle of Omaha" continues to be a key figure to watch, as his investment decisions always provide valuable insights into the evolving financial landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett Reduce Apple Stock: A 13% Decrease Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Guelphs Current Weather Conditions And Forecast

Apr 25, 2025

Guelphs Current Weather Conditions And Forecast

Apr 25, 2025 -

National Car Repair Groups Collapse Creditors Owed 4 7 Million

Apr 25, 2025

National Car Repair Groups Collapse Creditors Owed 4 7 Million

Apr 25, 2025 -

Legends Prophecy Galvins Departure From The Tigers And Path To Peace With Teammates

Apr 25, 2025

Legends Prophecy Galvins Departure From The Tigers And Path To Peace With Teammates

Apr 25, 2025 -

Prolong The Life Of Your Dyson Airwrap 6 Effective Strategies

Apr 25, 2025

Prolong The Life Of Your Dyson Airwrap 6 Effective Strategies

Apr 25, 2025 -

Apple Intelligence Website Change Available Now Tag Removed

Apr 25, 2025

Apple Intelligence Website Change Available Now Tag Removed

Apr 25, 2025

Latest Posts

-

Stablecoins As A Strategic Tool Enhancing Bank Liquidity And Deposits

Apr 30, 2025

Stablecoins As A Strategic Tool Enhancing Bank Liquidity And Deposits

Apr 30, 2025 -

Hans Zimmers Underestimated Masterpiece A Blockbuster Success Story

Apr 30, 2025

Hans Zimmers Underestimated Masterpiece A Blockbuster Success Story

Apr 30, 2025 -

Cotas De Imoveis Uma Alternativa Inteligente Para Casas De Veraneio

Apr 30, 2025

Cotas De Imoveis Uma Alternativa Inteligente Para Casas De Veraneio

Apr 30, 2025 -

Doge And Public Sector Privacy A Necessary Re Evaluation Of Data Security

Apr 30, 2025

Doge And Public Sector Privacy A Necessary Re Evaluation Of Data Security

Apr 30, 2025 -

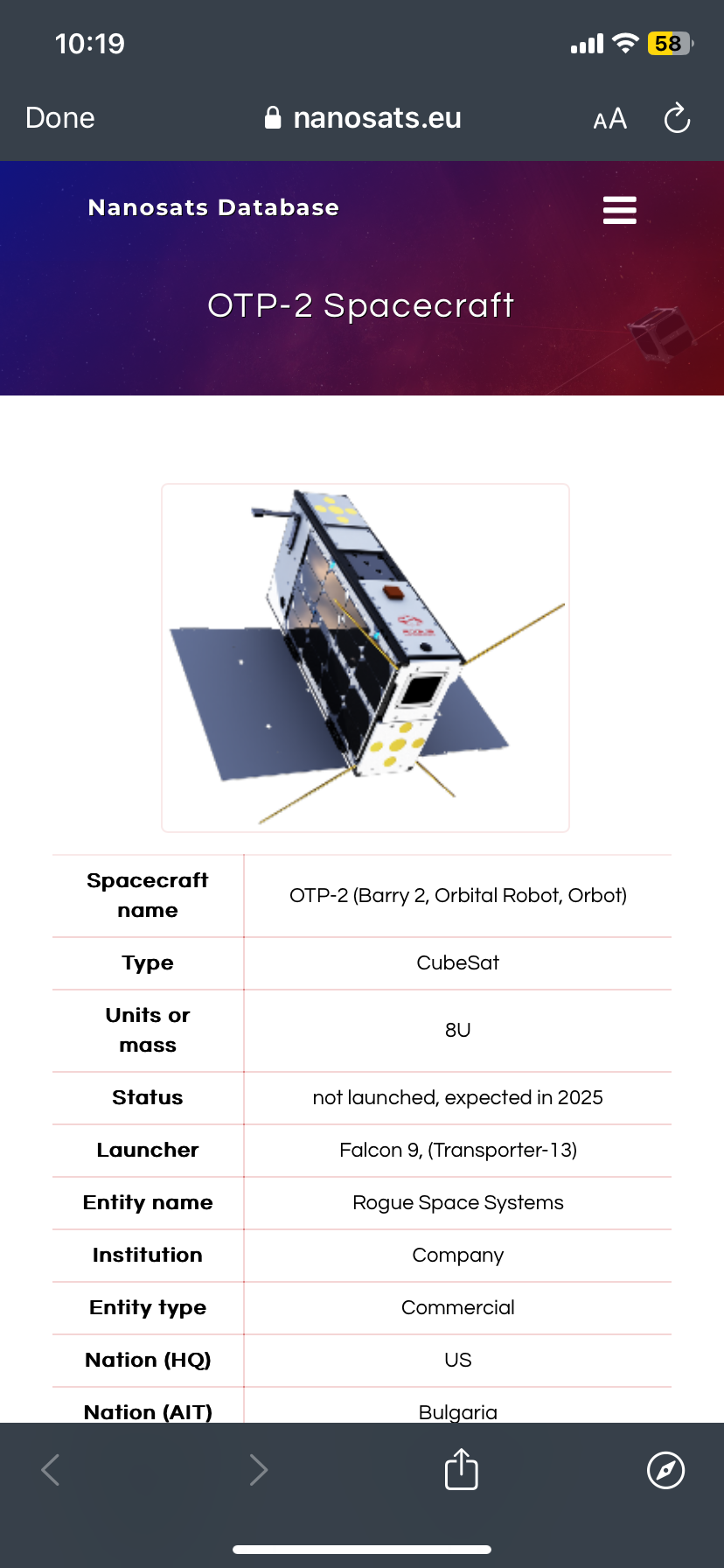

Otp 2 Propulsion Experiments Two Breakthrough Tests Analyzed

Apr 30, 2025

Otp 2 Propulsion Experiments Two Breakthrough Tests Analyzed

Apr 30, 2025