Which Is More Attractive After The Nasdaq Sell-Off: PANW Or NVDA?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

PANW vs. NVDA: Which Tech Titan is More Attractive After the Nasdaq Sell-Off?

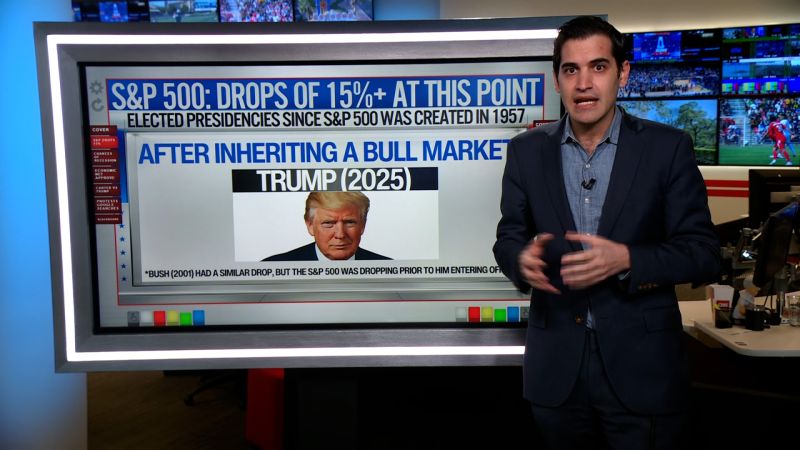

The recent Nasdaq sell-off has left many investors wondering which tech giants offer the most compelling investment opportunities. Two prominent names frequently mentioned are Palo Alto Networks (PANW) and Nvidia (NVDA), both significant players in the technology sector but with distinct strengths and vulnerabilities. This analysis compares PANW and NVDA, exploring their post-sell-off attractiveness, considering factors like growth potential, valuation, and market sentiment.

Understanding the Post-Sell-Off Landscape:

The recent downturn in the Nasdaq, driven by factors like rising interest rates and concerns about inflation, has created a challenging environment for growth stocks. However, it also presents opportunities for discerning investors to acquire high-quality companies at potentially discounted prices. Both PANW and NVDA experienced significant corrections, but their prospects differ significantly.

Palo Alto Networks (PANW): A Cybersecurity Leader

PANW, a leader in cybersecurity solutions, offers a relatively defensive posture compared to some other tech giants. The demand for robust cybersecurity infrastructure remains consistent, regardless of broader economic conditions. This resilience makes PANW an attractive option for investors seeking stability.

- Strengths: Strong recurring revenue model, consistent growth in subscription-based services, increasing demand for cloud security solutions.

- Weaknesses: Valuation might be considered relatively high compared to historical averages, competition in the crowded cybersecurity market.

- Post-Sell-Off Appeal: PANW's defensive nature and strong fundamentals make it a relatively attractive buy for investors seeking lower volatility and consistent growth. The correction may present a buying opportunity for long-term investors.

Nvidia (NVDA): The AI Powerhouse

NVDA, a dominant force in the graphics processing unit (GPU) market, is heavily reliant on the growth of artificial intelligence (AI) and related technologies. While AI presents tremendous long-term growth potential, its dependence on this sector makes NVDA more susceptible to market fluctuations.

- Strengths: Dominant market share in GPUs, crucial role in AI development and high-performance computing, significant growth potential in AI-related applications.

- Weaknesses: High valuation, dependence on the volatile AI market, potential for increased competition.

- Post-Sell-Off Appeal: While NVDA's long-term prospects remain strong, its high valuation and sensitivity to market shifts make it a riskier investment than PANW. The recent correction may offer a more attractive entry point, but investors should carefully assess their risk tolerance.

Head-to-Head Comparison:

| Feature | PANW | NVDA |

|---|---|---|

| Sector | Cybersecurity | Semiconductors, AI |

| Growth Potential | Steady, consistent growth | High growth potential, but volatile |

| Risk | Lower risk, more defensive | Higher risk, more growth-dependent |

| Valuation | Relatively high | Very high |

| Post-Sell-Off Appeal | Moderately attractive | Potentially attractive, but risky |

Conclusion:

The choice between PANW and NVDA after the Nasdaq sell-off depends heavily on individual investor risk tolerance and investment goals. PANW presents a more conservative option with steady growth and lower volatility. NVDA offers significantly higher growth potential but with increased risk. Investors seeking stability and consistent returns might favor PANW, while those with a higher risk tolerance and a long-term horizon might find NVDA more appealing despite its volatility. Thorough due diligence and a well-defined investment strategy are crucial before making any investment decisions. Consult with a financial advisor for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Which Is More Attractive After The Nasdaq Sell-Off: PANW Or NVDA?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Stock Market Crash Fears Rise As Dow Futures Tumble

Apr 07, 2025

Stock Market Crash Fears Rise As Dow Futures Tumble

Apr 07, 2025 -

Mobile Legends Pembagian Grup Resmi Turnamen Esl Sps Mobile Masters 2025

Apr 07, 2025

Mobile Legends Pembagian Grup Resmi Turnamen Esl Sps Mobile Masters 2025

Apr 07, 2025 -

Nhls Weegar Cool Under Pressure Fiery Response To Doubters

Apr 07, 2025

Nhls Weegar Cool Under Pressure Fiery Response To Doubters

Apr 07, 2025 -

I Was Honestly Britney Spears On The Demands Of Motherhood

Apr 07, 2025

I Was Honestly Britney Spears On The Demands Of Motherhood

Apr 07, 2025 -

Live Updates Mass Fight Mars Saints And Power Afl Clash Hogan Incident Investigated

Apr 07, 2025

Live Updates Mass Fight Mars Saints And Power Afl Clash Hogan Incident Investigated

Apr 07, 2025