Will Interest Rates Fall? Treasurer And Dutton Offer Contrasting Views

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Interest Rates Fall? Treasurer and Dutton Offer Contrasting Views

Australia is grappling with rising inflation and the subsequent impact on interest rates. The nation is keenly watching the Reserve Bank of Australia (RBA) and its monetary policy decisions, with considerable debate surrounding the future trajectory of interest rates. Adding fuel to the fire, Treasurer Jim Chalmers and Opposition Leader Peter Dutton have offered starkly contrasting views on whether we can expect relief anytime soon.

This divergence in opinion highlights the complexities of the economic situation and underscores the uncertainty facing Australian households and businesses. The question on everyone's mind: Will interest rates fall? The answer, unfortunately, isn't straightforward.

Chalmers: Cautious Optimism, But No Promises

Treasurer Chalmers struck a cautiously optimistic tone in his recent address to the National Press Club. While acknowledging the significant burden of rising interest rates on Australian families, he pointed to recent positive economic indicators as potential signs of easing inflation. He emphasized the government's commitment to responsible fiscal management as a key factor in navigating the current economic climate. However, he stopped short of predicting any imminent rate cuts.

- Key takeaway from Chalmers' statement: While positive economic signs exist, a reduction in interest rates is not guaranteed and depends heavily on continued progress in managing inflation. The government's focus remains on responsible economic management to create a stable environment for future rate decisions.

Dutton: Calls for Immediate Action

In contrast, Opposition Leader Peter Dutton has been far more critical of the government's handling of the economy and has called for more immediate action to alleviate the pressure on borrowers. He argues the current interest rate trajectory is unsustainable and is demanding more decisive intervention from the RBA. Dutton's stance reflects a growing concern within the opposition ranks about the government's economic strategy and its impact on voters.

- Key takeaway from Dutton's statement: The opposition believes the government's economic policies are insufficient, leading to unnecessary strain on households. They advocate for more aggressive measures to lower interest rates, suggesting the current approach is failing Australians.

The RBA's Tightrope Walk

The Reserve Bank of Australia finds itself navigating a delicate balancing act. The primary objective remains bringing inflation back down to the target range of 2-3%. This requires careful consideration of various economic factors, including wage growth, employment levels, and global economic conditions. While recent inflation data has shown some signs of moderation, the RBA has indicated a cautious approach, suggesting further rate hikes might be necessary before considering cuts.

- Factors influencing RBA decisions:

- Inflation rate: The primary driver of RBA policy.

- Wage growth: A key indicator of inflationary pressure.

- Unemployment rate: The RBA considers the impact on employment when setting rates.

- Global economic conditions: International economic factors influence Australia's economic outlook.

What Does This Mean for Australians?

The contrasting views of Chalmers and Dutton highlight the uncertainty surrounding future interest rate movements. For homeowners and borrowers, this creates a climate of apprehension. While some positive economic signs exist, the RBA's path forward remains unclear. Australians should prepare for continued uncertainty and carefully manage their finances in light of the evolving economic landscape. Monitoring official RBA statements and economic data will be crucial in understanding the future direction of interest rates.

The debate is far from over, and the coming months will be critical in determining whether interest rates will indeed fall. The ongoing interplay between government policy, RBA decisions, and evolving economic conditions will ultimately shape the financial future for millions of Australians.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Interest Rates Fall? Treasurer And Dutton Offer Contrasting Views. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

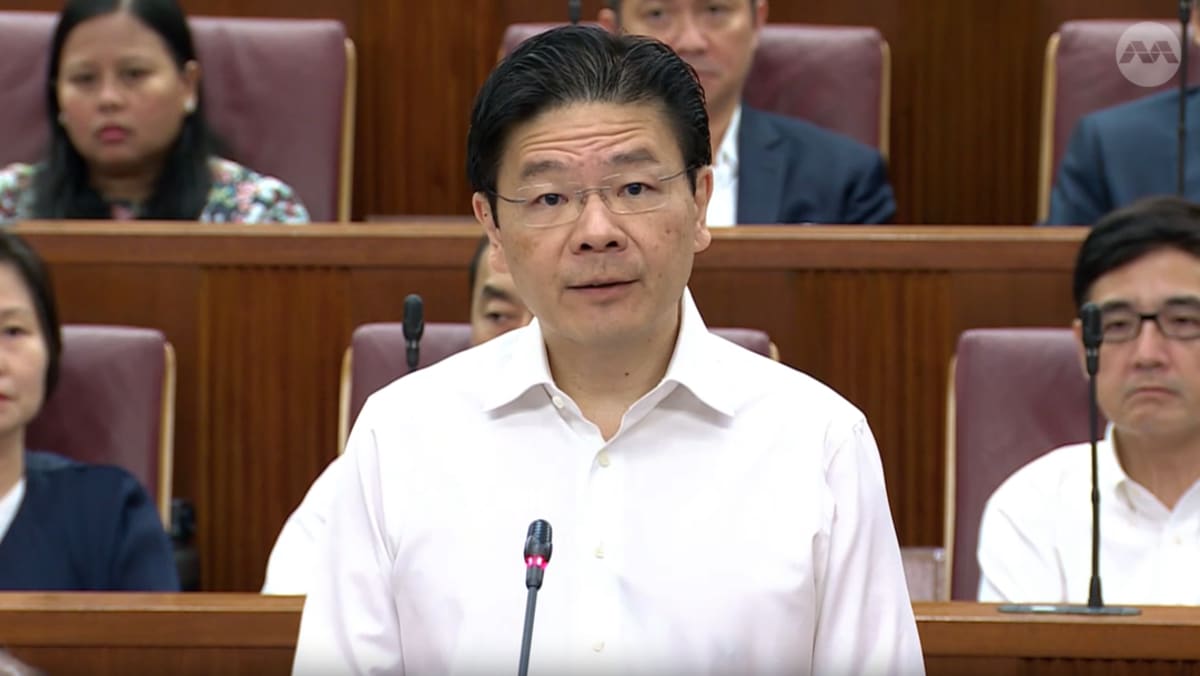

Trump Tariffs Singapore Pm Announces Support For Businesses And Workers

Apr 08, 2025

Trump Tariffs Singapore Pm Announces Support For Businesses And Workers

Apr 08, 2025 -

Tariff Hikes Trigger Netflix Stock Dip Investors React

Apr 08, 2025

Tariff Hikes Trigger Netflix Stock Dip Investors React

Apr 08, 2025 -

Sharpest Us Stock Market Decline Since Covid 19 Chinas Retaliatory Tariffs

Apr 08, 2025

Sharpest Us Stock Market Decline Since Covid 19 Chinas Retaliatory Tariffs

Apr 08, 2025 -

Nintendo Switch 2 Port Pricing Expect To Pay 65 For Classic Titles In The Uk

Apr 08, 2025

Nintendo Switch 2 Port Pricing Expect To Pay 65 For Classic Titles In The Uk

Apr 08, 2025 -

Two Stocks To Watch Amidst Market Uncertainty

Apr 08, 2025

Two Stocks To Watch Amidst Market Uncertainty

Apr 08, 2025