Bank Of Canada's Inflation Fight: CIBC's Perspective On Canada's Economic Trajectory

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bank of Canada's Inflation Fight: CIBC's Perspective on Canada's Economic Trajectory

Canada's economy is navigating choppy waters, grappling with persistent inflation and the Bank of Canada's aggressive interest rate hikes. While the headline inflation rate has eased, underlying price pressures remain stubbornly high, leaving economists and Canadians alike wondering about the country's economic trajectory. CIBC, one of Canada's leading financial institutions, offers a nuanced perspective on this complex situation, shedding light on the challenges and potential outcomes.

CIBC's Outlook: A Balancing Act

CIBC's economic analysts acknowledge the progress made in curbing inflation, but warn against premature celebrations. They highlight the ongoing tension between the Bank of Canada's commitment to price stability and the risk of triggering a significant economic slowdown. The bank's forecast suggests a delicate balancing act, aiming for a "soft landing" – a scenario where inflation decreases without plunging the economy into a deep recession.

Key Factors Shaping CIBC's Analysis:

- Persistent Wage Growth: CIBC emphasizes the persistent strength in wage growth as a key factor contributing to inflationary pressures. While higher wages are positive for workers, they can fuel a wage-price spiral if businesses pass increased labor costs onto consumers through higher prices.

- Housing Market Slowdown: The cooling housing market, a direct consequence of rising interest rates, is viewed by CIBC as a necessary but potentially painful element of the inflation-fighting strategy. A significant decline in housing prices could impact consumer confidence and overall economic activity.

- Global Economic Uncertainty: CIBC's analysis also incorporates the impact of global economic headwinds, including geopolitical instability and ongoing supply chain disruptions. These factors add complexity to the already challenging economic landscape.

- Resilient Consumer Spending: Despite rising interest rates, consumer spending has remained surprisingly resilient. This suggests that underlying demand remains strong, potentially prolonging the fight against inflation.

Interest Rate Expectations and Potential Scenarios:

CIBC anticipates that the Bank of Canada will maintain a cautious approach to monetary policy, potentially holding interest rates steady for an extended period to assess the impact of previous hikes. However, the bank acknowledges the possibility of further rate increases if inflation remains stubbornly high or if wage growth accelerates unexpectedly. Their analysis outlines several potential economic scenarios, ranging from a relatively mild slowdown to a more significant recession, depending on the effectiveness of the Bank of Canada's actions and the evolution of global economic conditions.

What This Means for Canadians:

CIBC's analysis provides valuable insights for Canadians navigating the current economic climate. Understanding the interplay between inflation, interest rates, and the housing market is crucial for making informed financial decisions. The forecast highlights the importance of responsible financial planning, including careful debt management and diversification of investments.

Conclusion: Navigating the Uncertainty

The Bank of Canada's inflation fight is far from over. CIBC's perspective offers a realistic assessment of the challenges ahead, emphasizing the need for a nuanced approach that balances price stability with economic growth. While the path forward remains uncertain, understanding the key factors shaping Canada's economic trajectory, as highlighted by CIBC's analysis, is crucial for individuals, businesses, and policymakers alike. The coming months will be critical in determining whether Canada can achieve a soft landing or face a more significant economic downturn.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bank Of Canada's Inflation Fight: CIBC's Perspective On Canada's Economic Trajectory. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Live Euro Millions And Thunderball Draw Winning Numbers For Friday May 23rd

May 25, 2025

Live Euro Millions And Thunderball Draw Winning Numbers For Friday May 23rd

May 25, 2025 -

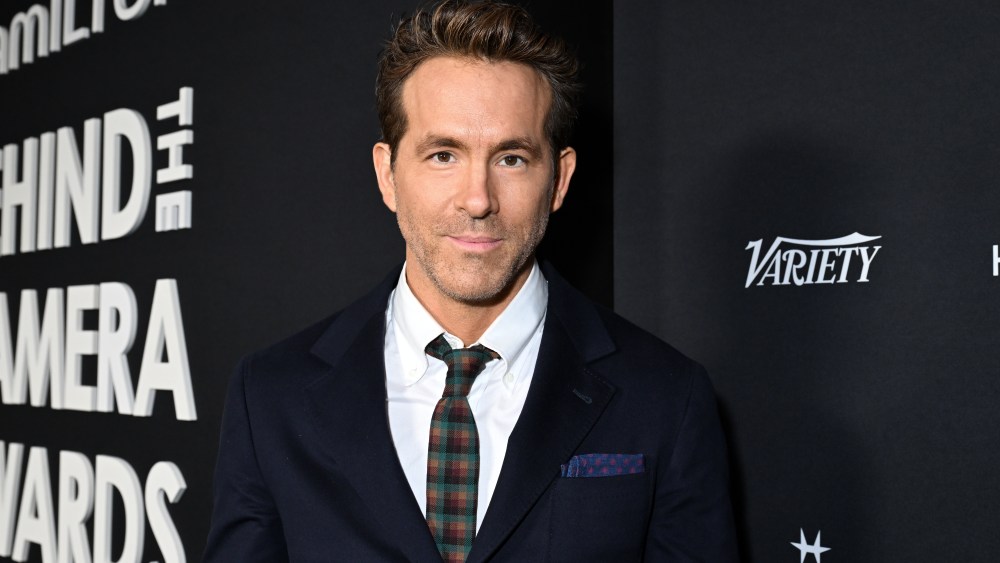

Ryan Reynolds Star Wars Vision An R Rated Twist Disney Passed On

May 25, 2025

Ryan Reynolds Star Wars Vision An R Rated Twist Disney Passed On

May 25, 2025 -

Robert Pattinsons Hilarious Multi Role Performance In 131 Million Space Comedy

May 25, 2025

Robert Pattinsons Hilarious Multi Role Performance In 131 Million Space Comedy

May 25, 2025 -

Groundbreaking Ssd Feature Complete Data Rewrite Every 24 Hours

May 25, 2025

Groundbreaking Ssd Feature Complete Data Rewrite Every 24 Hours

May 25, 2025 -

Americas Biggest Banks Partner On Potential Stablecoin

May 25, 2025

Americas Biggest Banks Partner On Potential Stablecoin

May 25, 2025

Latest Posts

-

Could Solana Sol Reach 200 Examining The Technical Setup

May 25, 2025

Could Solana Sol Reach 200 Examining The Technical Setup

May 25, 2025 -

Moodeng Price Soars Post Robinhood Listing Breakout Potential

May 25, 2025

Moodeng Price Soars Post Robinhood Listing Breakout Potential

May 25, 2025 -

Mel Gibson Guns And A Trump Firing The Untold Story

May 25, 2025

Mel Gibson Guns And A Trump Firing The Untold Story

May 25, 2025 -

Acoes Que Pagam Dividendos Eletrobras Caixa Seguridade E As Principais Da Semana

May 25, 2025

Acoes Que Pagam Dividendos Eletrobras Caixa Seguridade E As Principais Da Semana

May 25, 2025 -

Lawrence Livermore National Lab Reports 4x Energy Gain In Laser Fusion Experiment

May 25, 2025

Lawrence Livermore National Lab Reports 4x Energy Gain In Laser Fusion Experiment

May 25, 2025