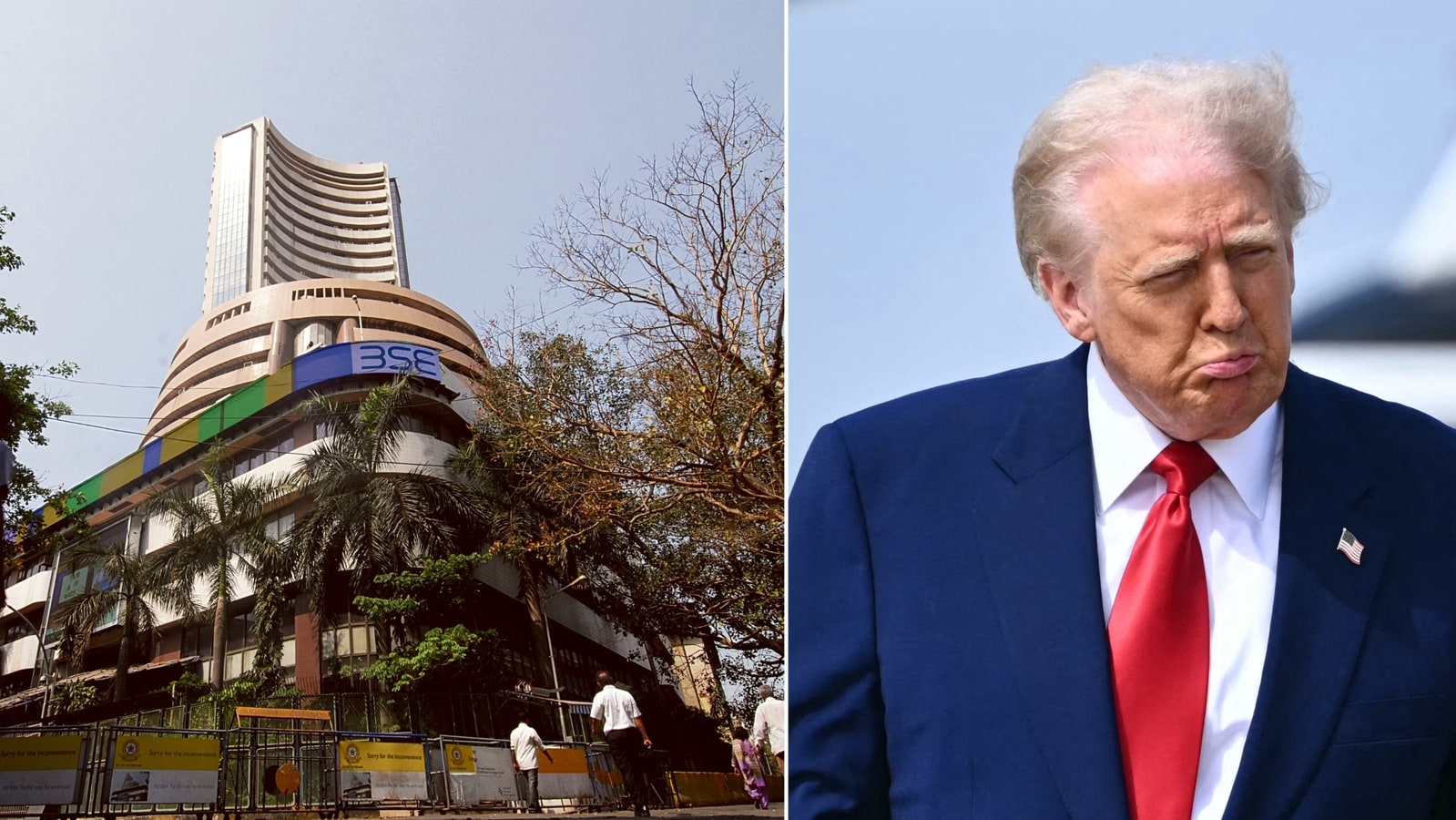

Explaining Today's Sharp Fall In The Indian Stock Market: Sensex And Nifty Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Explaining Today's Sharp Fall in the Indian Stock Market: Sensex and Nifty Analysis

India's stock market experienced a significant downturn today, leaving investors wondering about the causes behind the sharp decline in both the Sensex and Nifty indices. This unexpected volatility raises concerns about the overall health of the Indian economy and future market trends. Let's delve into the potential factors contributing to this sudden fall.

Understanding the Drop: Sensex and Nifty Plunge

The Sensex and Nifty, key indicators of the Indian stock market's performance, witnessed a considerable drop today. This isn't just a minor fluctuation; it's a substantial fall that has sent ripples through the investment community. Understanding the reasons behind this requires examining several interconnected factors.

Key Factors Contributing to the Market Fall:

-

Global Market Uncertainty: The global economic landscape plays a significant role in influencing Indian markets. Recent anxieties surrounding [mention specific global events, e.g., rising interest rates in the US, geopolitical tensions, etc.] have created a risk-averse sentiment among international investors, leading to capital outflows from emerging markets like India. This is a major factor impacting both the Sensex and Nifty today.

-

Inflation Concerns: Persistent inflationary pressures within India continue to be a major concern. Rising prices of essential commodities and fuel directly impact consumer spending and corporate profitability, making investors hesitant to invest heavily. The Reserve Bank of India's (RBI) monetary policy and its impact on inflation expectations are crucial elements in this equation.

-

Rupee Depreciation: A weakening Indian Rupee against major currencies like the US dollar can negatively affect investor sentiment. Import costs increase, potentially impacting profitability for businesses and causing further market instability. The current exchange rate and its recent trends are key indicators to watch.

-

Sector-Specific Headwinds: Specific sectors might be experiencing unique challenges. For example, [mention any specific sector facing difficulties, e.g., a slowdown in the IT sector, regulatory changes impacting a specific industry, etc.] could be contributing to the overall market downturn. Analyzing sector-specific performance is crucial for understanding the complete picture.

-

Profit-Booking: After a period of sustained growth, investors may engage in profit-booking, selling off assets to secure their gains. This can trigger a chain reaction, leading to further selling pressure and exacerbating the market decline.

Nifty and Sensex: A Deeper Dive

Both the Nifty 50 and the Sensex 30 indices reflect the overall market sentiment. Today's fall indicates a widespread negative outlook among investors. Analyzing the individual stocks within these indices that contributed most significantly to the decline can provide further insights into specific sectors facing challenges.

What to Expect Next:

Predicting short-term market movements is inherently challenging. However, closely monitoring the following factors can offer a clearer understanding of future trends:

- RBI's Actions: The RBI's upcoming monetary policy announcements and any interventions will significantly impact market sentiment.

- Global Economic Developments: International events and their impact on the Indian economy will continue to be crucial factors.

- Government Policies: Government initiatives and policy changes can influence market performance.

Conclusion:

Today's sharp fall in the Indian stock market, reflected in both the Sensex and Nifty, is a complex issue stemming from a confluence of global and domestic factors. While short-term volatility is expected, understanding these underlying causes is vital for investors to make informed decisions. Continuous monitoring of global and domestic economic indicators is crucial for navigating this period of market uncertainty. Consult with financial advisors for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Explaining Today's Sharp Fall In The Indian Stock Market: Sensex And Nifty Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Save Money On Coffee And More Sg 60 Promotions At 140 Coffee Shops

Apr 08, 2025

Save Money On Coffee And More Sg 60 Promotions At 140 Coffee Shops

Apr 08, 2025 -

Levis Beats Sales Estimates Denim Drives Quarterly Growth

Apr 08, 2025

Levis Beats Sales Estimates Denim Drives Quarterly Growth

Apr 08, 2025 -

Nvidia Or Palo Alto Networks A Post Nasdaq Sell Off Stock Comparison

Apr 08, 2025

Nvidia Or Palo Alto Networks A Post Nasdaq Sell Off Stock Comparison

Apr 08, 2025 -

Predicting The 2025 Masters Weather Comprehensive Forecasts For Players And Fans

Apr 08, 2025

Predicting The 2025 Masters Weather Comprehensive Forecasts For Players And Fans

Apr 08, 2025 -

Nasdaq Sell Off Evaluating Palo Alto Networks And Nvidia Stock Prices

Apr 08, 2025

Nasdaq Sell Off Evaluating Palo Alto Networks And Nvidia Stock Prices

Apr 08, 2025