No Rate Cut In April: Reserve Bank's Decision And Its Impact On Australian Households

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

No Rate Cut in April: Reserve Bank Holds Steady, Leaving Aussie Households in Limbo

The Reserve Bank of Australia (RBA) has delivered a blow to many hoping for immediate relief from soaring interest rates, announcing it will hold the official cash rate at 3.6% in April. This decision, while anticipated by some economists, leaves Australian households grappling with the ongoing cost of living crisis and uncertainty about future rate movements. The RBA's statement highlights a complex economic landscape, balancing inflationary pressures with the potential for further economic slowdown.

RBA's Reasoning: A Balancing Act Between Inflation and Growth

The RBA's decision to maintain the cash rate underscores its commitment to tackling inflation, currently sitting above its target band. Governor Philip Lowe cited persistent inflationary pressures, particularly in the services sector, as a key factor in the decision. While acknowledging the slowing growth in the Australian economy, the RBA emphasized the need for further monitoring of inflation before considering any rate cuts.

The statement highlighted several key considerations:

- Persistent Inflation: Core inflation remains stubbornly high, indicating underlying price pressures that require sustained attention.

- Strong Labour Market: The robust labour market, while positive for employment, also contributes to upward wage pressure, further fueling inflation.

- Global Economic Uncertainty: Geopolitical risks and global economic headwinds add complexity to the RBA's decision-making process.

Impact on Australian Households: Ongoing Pressure and Uncertainty

For many Australian households, the news is a setback. Mortgage holders already facing increased repayments will continue to shoulder the burden of higher interest rates. This ongoing pressure significantly impacts household budgets, limiting discretionary spending and potentially hindering economic growth.

The RBA's decision creates uncertainty for the future. While some economists predict potential rate cuts later in the year, the timing remains unclear, leaving many homeowners and businesses in a state of limbo. This uncertainty hampers long-term financial planning and investment decisions.

What Lies Ahead: Potential Scenarios and Market Reactions

The RBA's decision has sparked debate among economists, with opinions diverging on the future trajectory of interest rates. Some anticipate further rate hikes if inflation remains persistent, while others predict cuts as the economy slows. The Australian dollar experienced a slight dip following the announcement, reflecting market reactions to the news.

Key questions remain unanswered:

- When will rate cuts begin? The RBA's communication suggests a data-dependent approach, with future decisions hinging on inflation and economic growth figures.

- How significant will future rate cuts be? The magnitude of any future cuts will depend on the evolving economic landscape.

- What support measures will the government implement? Government initiatives targeting cost-of-living pressures could play a crucial role in mitigating the impact on households.

The coming months will be critical in determining the next steps for the RBA. Close monitoring of economic indicators, particularly inflation data, will be crucial in shaping future monetary policy decisions. For Australian households, navigating the current economic climate requires careful financial planning and a close watch on RBA announcements. This situation highlights the importance of seeking professional financial advice to navigate these challenging times.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on No Rate Cut In April: Reserve Bank's Decision And Its Impact On Australian Households. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Inflacao Ipca Copom E O Cenario Industrial Brasileiro

May 08, 2025

Inflacao Ipca Copom E O Cenario Industrial Brasileiro

May 08, 2025 -

Multi Year Partnership Extension Announced Ticketmaster And Crown Resorts

May 08, 2025

Multi Year Partnership Extension Announced Ticketmaster And Crown Resorts

May 08, 2025 -

Cryptocurrencys Tax Code Lags Behind Its Rapid Evolution

May 08, 2025

Cryptocurrencys Tax Code Lags Behind Its Rapid Evolution

May 08, 2025 -

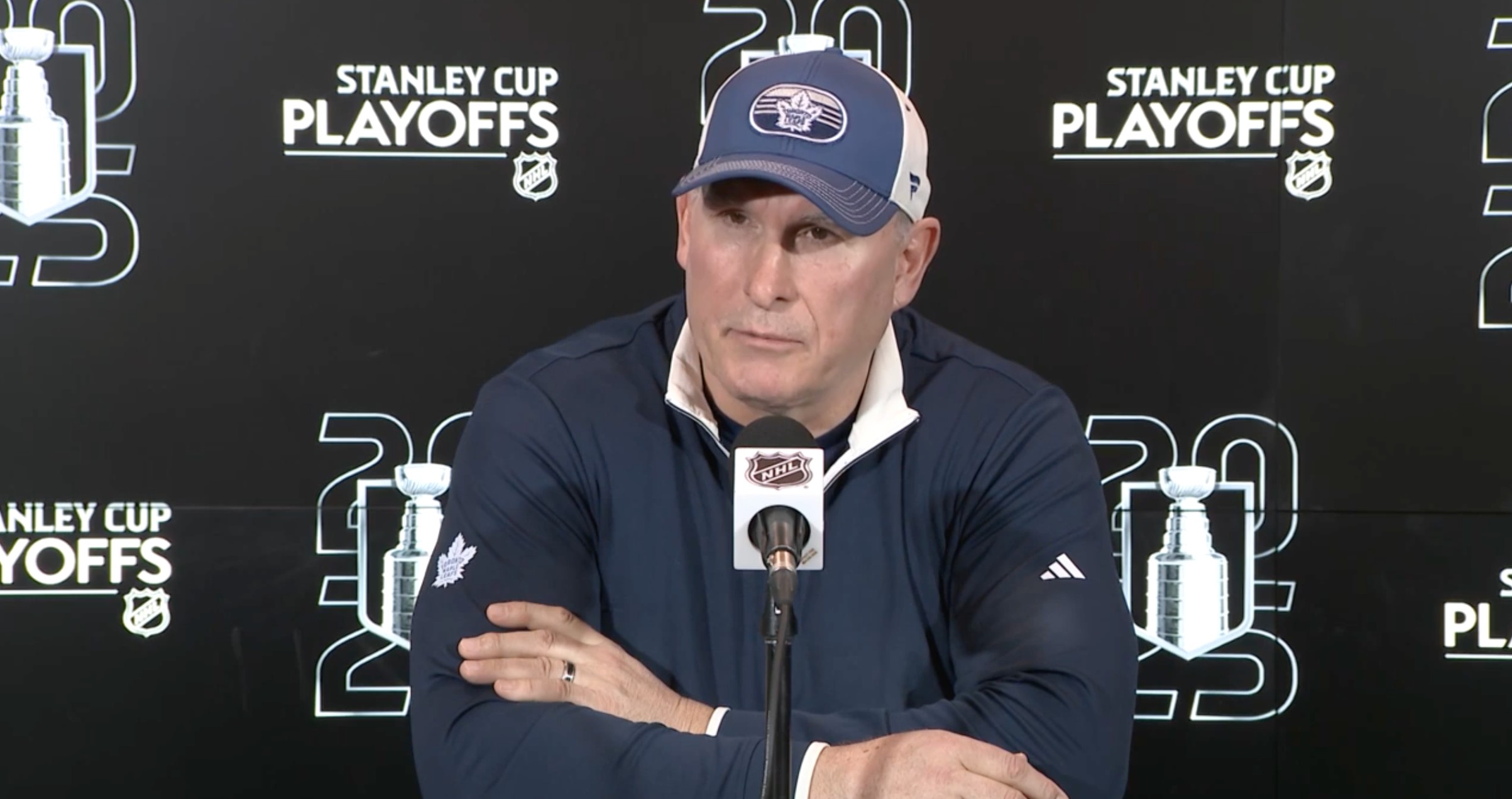

Berube On Hurricanes Playoff Odds Underdogs But A Good Team

May 08, 2025

Berube On Hurricanes Playoff Odds Underdogs But A Good Team

May 08, 2025 -

Analyzing The Potential Effects Of Trumps Tariffs On Australian Film Imports

May 08, 2025

Analyzing The Potential Effects Of Trumps Tariffs On Australian Film Imports

May 08, 2025

Latest Posts

-

Westbrooks Future The Nuggets Crucial Choice To Eliminate Thunder Threat

May 08, 2025

Westbrooks Future The Nuggets Crucial Choice To Eliminate Thunder Threat

May 08, 2025 -

Pakistan Ministers No Terror Camps Statement A Live Tv Fact Check Analysis

May 08, 2025

Pakistan Ministers No Terror Camps Statement A Live Tv Fact Check Analysis

May 08, 2025 -

Sonos And Ikea End Partnership What This Means For Smart Home Speakers

May 08, 2025

Sonos And Ikea End Partnership What This Means For Smart Home Speakers

May 08, 2025 -

From Broken Brains To Coherent Narratives The Healing Power Of Creative Writing

May 08, 2025

From Broken Brains To Coherent Narratives The Healing Power Of Creative Writing

May 08, 2025 -

Fight Or Flight Pc Console Review A Detailed Look

May 08, 2025

Fight Or Flight Pc Console Review A Detailed Look

May 08, 2025