Sensex And Nifty Plunge: Unpacking The Reasons Behind Today's Indian Market Fall

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Sensex and Nifty Plunge: Unpacking the Reasons Behind Today's Indian Market Fall

Indian stock markets experienced a significant downturn today, with both the Sensex and Nifty plunging sharply. This unexpected fall has left investors wondering about the underlying causes. While pinpointing a single reason is difficult, a confluence of factors likely contributed to this market volatility. Let's delve into the key elements that fueled this dramatic drop.

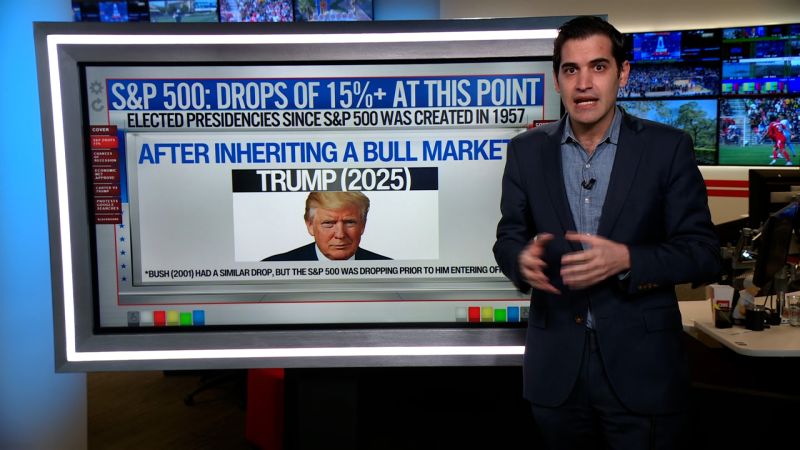

Global Headwinds: A Ripple Effect on Indian Markets

The global economic landscape is far from stable. Rising interest rates in major economies like the US continue to exert pressure on emerging markets, including India. Concerns about a potential global recession, fueled by persistent inflation and geopolitical uncertainties, are impacting investor sentiment worldwide. This negativity is directly impacting foreign portfolio investment (FPI) flows into India, leading to selling pressure on domestic stocks. The recent weakness in the US dollar against other major currencies also plays a role, impacting the relative attractiveness of Indian assets.

Domestic Concerns: Inflation and RBI Policy

While global factors play a significant role, domestic issues are equally important. Persistent inflationary pressures in India, although showing signs of moderation, remain a concern for the Reserve Bank of India (RBI). The RBI's monetary policy decisions, aimed at controlling inflation, can have a direct impact on market sentiment. Any perceived hawkish stance by the RBI, signaling further interest rate hikes, can trigger selling in the stock market. Further adding to the pressure, the upcoming Union Budget also introduces an element of uncertainty, with investors closely watching for potential policy changes that could affect various sectors.

Sector-Specific Weakness:

Today's fall wasn't uniform across all sectors. Specific sectors experienced disproportionately large drops, indicating sector-specific headwinds. For instance, a decline in the IT sector, often sensitive to global economic slowdown and currency fluctuations, could have significantly contributed to the overall market decline. Similarly, any negative news concerning a major company within a specific sector can trigger a sell-off, further exacerbating the market's downward trend. Analyzing sector-specific performance is crucial for understanding the nuances of today's market fall.

What Does This Mean for Investors?

The sharp decline in the Sensex and Nifty is a reminder of the inherent volatility in the stock market. While a short-term correction is possible, long-term investors should avoid panic selling. It’s crucial to adopt a long-term investment strategy, focusing on fundamental analysis and diversification. Consult with a financial advisor to reassess your portfolio and make informed decisions based on your risk tolerance and financial goals.

Key Takeaways:

- Global factors: Rising interest rates, recession fears, and geopolitical tensions are impacting investor sentiment globally.

- Domestic factors: Inflationary pressures and RBI's monetary policy decisions influence Indian market sentiment.

- Sector-specific weakness: Certain sectors experienced greater declines, emphasizing the need for sector-specific analysis.

- Investor advice: Long-term investors should avoid panic selling and consult financial advisors for guidance.

Staying informed about market trends and economic news is crucial for making sound investment decisions. Regularly monitoring news sources and seeking professional advice will help navigate the inherent uncertainties of the stock market. The current market downturn, while significant, doesn't necessarily signal a long-term bearish trend. A careful analysis of the underlying factors is key to understanding the market's dynamics and making informed investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Sensex And Nifty Plunge: Unpacking The Reasons Behind Today's Indian Market Fall. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Suzuka Fire Delays Japanese Grand Prix F1 Awaits Weather Update

Apr 07, 2025

Suzuka Fire Delays Japanese Grand Prix F1 Awaits Weather Update

Apr 07, 2025 -

Amazon Stock A Smart Investment Opportunity In 2024

Apr 07, 2025

Amazon Stock A Smart Investment Opportunity In 2024

Apr 07, 2025 -

Indian Market Crash Today Sensex And Nifty Fall Explained

Apr 07, 2025

Indian Market Crash Today Sensex And Nifty Fall Explained

Apr 07, 2025 -

Investor Fear Grips Markets Dow Futures Reflect Ongoing Sell Off

Apr 07, 2025

Investor Fear Grips Markets Dow Futures Reflect Ongoing Sell Off

Apr 07, 2025 -

Angels Offensive Explosion Leads To Commanding Victory Over Guardians

Apr 07, 2025

Angels Offensive Explosion Leads To Commanding Victory Over Guardians

Apr 07, 2025